Price Overview

The petroleum complex recovered toward unchanged levels from session lows near 40.00 basis December crude as buying interest developed in response to a constructive US retail sales report along with assurances by the OPEC Secretary General that they will ensure oil prices do not plunge steeply again when they meet to set policy at the end of November. Fears that the recovery is not picking up at a rate they had anticipated earlier in the year has helped direct attention to the impact a planned production hike early in 2021 might have on stock levels. Although there has been progress at bringing inventories down from the levels seen when many economies shut down in the 2nd quarter, concerns that the recovery will slow as we move into winter, along with the recent spike in infections in the US and Europe, continues to weigh on sentiment and suggests OPEC will need to be cautious in expanding production.

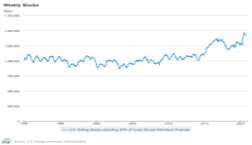

In the most recent IEA report, the agency estimated that OECD stocks fell by 22.1 mb to 3,194, and were 209.1 mb above their five year average. Preliminary data for September show that crude stocks in the US and Japan fell by 6.5 and 1.8 mb respectively while those in Europe rose by 3.3. Overall implied global stocks fell by 2.3 mb/d in the 3rd quarter of 2020 and are currently projected to fall by 4.1 mb/d during the 4th quarter. The DOE report released yesterday showed US commercial crude inventories falling by 3.8 mb while gasoline inventories fell 1.6 and distillate inventories dropped sharply by 7.2 mb. Total stocks of crude and products (see chart above) declined by 16.8 mb and currently stand at 1,402 mb compared to 1,282 last year . Although petroleum stocks have declined, they are still well above historical levels and only now coming down in the area of record highs reached in mid 2016.

This poses risks to the market particularly if demand is restrained and stocks begin to rise unexpectedly. Given the election ahead and doubts that a compromise will be reached on a new stimulus package, the market will be attentive to underlying forces that could restrain economic growth and likewise demand. Fear of bankruptcies and defaults along with longer term structural changes to work habits and commuting all have the potential to be disruptive forces. The impact of these variables on demand trends will be a key factor in determining how quickly stocks will be drawn down in the months ahead.

Natural Gas

The market has been difficult to gauge as volatility remains high and a definitive trend has been hard to establish. Prices managed to claw back the losses seen at mid-week as December ended the day up a penny at 3.271. Most of the recovery occurred yesterday as the market reacted to another upswing in HDD expectations and a lower than expected build in stocks. The 46 bcf increase was well below estimates near 55 and the five year average of 87. LNG flows continue to improve, albeit slowly, with early feedstock estimates today at 7.8 bcf/d verses 7.6 yesterday with Cameron still hampered by debris in the Calcasieu ship channel. Asian and European LNG prices have continued to firm, which is a positive sign for exports if the US can get back to full capacity. Limiting the rally has been a solid rebound in production levels, as today’s output will likely be near 88 bcf after late revisions, a level not seen since September. We continue to look for prices to work higher as we head into withdrawal season and LNG exports improve. Weather demand will need to be watched closely as long term forecasts are currently suggesting lower HDD demand this winter. As we turn our attention to the December contract, look for trend line resistance near today’s highs above 3.31 to be tested next week, and a failure to follow through at those levels could lead to a drop to the 3.18-3.20 range.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.