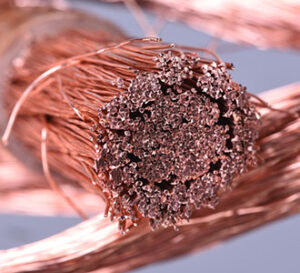

COPPER

Unfortunately for the bull camp, the daily pattern of LME copper stocks inflows extended again overnight but fortunately for the bull camp the more important Chinese demand market showed Shanghai copper warehouse stocks down 14.9% or 9,138 tons. However, even with a stronger than expected Chinese Caixin services PMI reading yesterday, the copper market forged a lower low for the move. We suspect soft US jobs data today combined with an unusual surge in US interest rates in the face of weak data, ongoing builds in daily LME copper warehouse stocks and a stronger dollar has prompted the early slide in copper prices. However, the market might have drafted some short covering relief from a stronger than expected US factory order result. In today’s action, the US nonfarm payroll report is likely to set off a chain reaction with the largest impact on copper prices likely to be US interest rates. It should be noted that treasuries are significantly oversold after days of selling in the face of weak data and therefore even soft US data today could leave the selling trend in place.

GOLD / SILVER

Even though the overnight declines in gold and silver are modest, the rally in the dollar index is also small leaving currency related selling in gold and silver somewhat limited early on. While the decline in gold yesterday was not severe, the market did make a lower low and was pressured by a significant jump in US interest rates. Fortunately for the bull camp, offsetting the jump in rates was off balance US dollar action. Yesterday gold ETF holdings were reduced by a mere 775 ounces, but the outflow was the 9th straight day of outflows. Silver ETF holdings also saw a decline yesterday, putting holdings down for the last 4 trading sessions. Adding into the downward bias in gold and silver prices is news from the Perth Mint that July gold product sales posted their lowest level since October 2020, with silver sales posting 3-year lows. In the end, with the dollar showing signs of extending on the upside, even in the face of soft US jobs related data, the bias looks to be entrenched in the downside.

PLATINUM / PALLADIUM

With a lower low today extending a very uniform pattern of lower lows and open interest surging on the last 4 weeks’ slide in platinum prices, the bear camp should be confident into the last trading session of the week. In a minor bullish development, a South African platinum mine remains closed due to an illegal strike but the trade is not apparently easily concerned about a minimal disruption of supply. As indicated earlier this week, a failure to see platinum benefit to a strong developing pattern of US light vehicle sales, the market does not appear to be interested in the prospect of improving physical demand. Therefore, we assume the disappointment over the Chinese economy remains in place despite the positive Chinese Caixin services PMI reading for July released yesterday. The palladium trade continues to be uninteresting with the tight coiling pattern extending and little change in daily ETF holdings.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.