by market analysts Stephen Platt and Mike McElroy

Price Overview

Crude oil attracted good underlying support after shaking off early selling pressure linked to reports that Chinese officials had reiterated their commitment to strict Covid containment measures for now. The support carried values to as high as 93.74 basis December before weakness in the products undermine values.

A combination of influences attracted buying interest to crude, as the end of SPR releases could signal a substantial decline in crude inventories. In addition, the US and G-7 sanctions going into effect on December 5th are supportive due to the further reduction in Russian availability. With OPEC+ calling for output cuts, the supply side of crude appears tenuous at best. In the background was the strength to equity markets and weakness to the dollar. Signs that the expansion in US crude production might be stalling also provided longer term support.

Although crude has recently shown solid upside movement, weakness in the ULSD and gasoline crack suggests a mixed tone for the complex. Recent expansion in refinery capacity has taken place, and given the historically high cracks, weakness could continue. Concerns over demand persist along with our belief that secondary inventories have been built up, particularly in Europe. The following charts for the December 2 oil and gasoline crack highlight this conundrum and could foreshadow some tempering in crude strength, particularly if demand for these products in China and the US are scaled back due to high prices and a slowdown in economic growth. Near term crude might falter if weakness in the cracks persist and better availability from Russia ahead of the heightened sanctions and on a recovery in Chinese product exports. Declines will likely be limited to the 85.50 area as questions over inventories reemerge in advance of price caps and the embargo of Russian crude oil imports by the EU on December 5th.

The DOE report on Wednesday is estimating crude stocks rising by 1.1 mb, distillates off 1.4 and gasoline down 1.0. Refinery utilization is expected higher by .6 to 90.2 percent.

Natural Gas

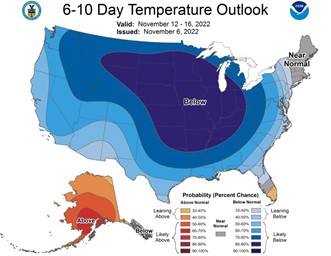

The market kicked off the week with a substantial gap higher as the December contract was up 58 cents on the reopen and ended the session near those levels, settling at 6.944 for a gain of 54.4 cents on the day. Weather continues to be the driver as weekend forecast revisions turned significantly colder into the second half of the month. The move was likely intensified by fund liquidation as they held a large short position ahead of the rally that has seen prices higher by nearly a dollar over the last two sessions. Production added a supportive influence, remaining below 98.5 bcf/d over the weekend as we move closer to the expected return of Freeport LNG. With the large gap higher and significant short term move the market looks overdone on the upside. Initial support on a pullback arises in the 7.375 area, with a likely target a filling of this morning’s gap near 6.50. Upside follow-through will find resistance at the 50 percent retracement of the September/October break near 7.38 and then at the 100-day moving average currently at 7.54.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.