by market analysts Stephen Platt and Mike McElroy

Price Overview

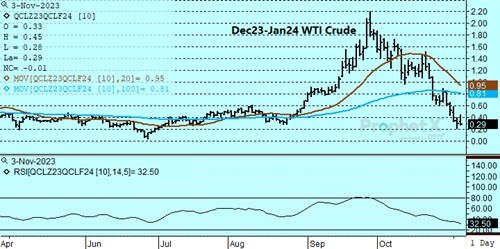

Crude oil established new lows for the move at 80.10, settling at 80.51 basis December and below the 100-day moving average at 81.42. The Gaza conflict remains in the background but the absence of an expansion in the conflict is limiting buying interest, with the market focusing on macro developments. Reports that US jobs growth dropped more than expected while wage inflation cooled pointed to a slowing in labor market. Prospects that GNP will also slow despite a pause in interest rate movement raised questions over demand. In addition, the course of the Chinese economy moved back into focus following a decline in manufacturing activity in October. The PMI fell back into contraction at 49.5 following a reading of 50.2 in September. Another survey showed the Chinese private sector expanded at a slightly better pace in October, but sales grew at the softest rate in 10 months while employment stagnated as business confidence waned. The supply side was ignored, with additional sanctions imposed by the US on Russia appearing to have negligible impact while Saudi Arabia is expected to confirm an extension of its voluntary output cut into December.

The easing of supply tightness has been evident with the weakness in the forward curve, as the Dec-Jan crude spread moved to its lowest levels since August. The lack of support to the backwardation has raised questions over supply tightness despite forecasts of a substantial tightening as we move into the end of the year, which might reflect the expansion in US production to record levels along with increases from other non-OPEC producers.

The market is oversold and continues to assess supply availability along with tensions in Gaza. The reluctance of Lebanon’s Hezbollah to engage Israeli forces has helped temper the risk premium. In addition, the fact that the Saudi’s remain on the sidelines due to their interest in improving relations with the US and seeing stability return to the region as quickly as possible has discouraged buying. The ground war in Gaza will be a slow grind, but an increase in aid as Israeli positions become established in the area is slowly moving along. With interest rates showing stability and tempered inflationary pressures, the economy is on more stable footing, which should be favorable to demand. In addition, reports that Iranian export levels have recently fallen should maintain a tight inventory outlook into the end of the year, which should ease as we move into early 2024 as high US production levels offset OPEC+ cuts.

Natural Gas

The market ended the day with a gain of 4.3 cents at 3.515, trading within Tuesday’s wide range throughout the second half of the week. Volume was light as fundamental changes were minimal. Yesterday’s storage report showed a 79 bcf build, which was near estimates at 80. Prices made the days lows on the release, but quickly rebounded. Buying was noted on concern that next weeks report could show the first withdrawl of the season, but trade will not have that number until the following week as the EIA will be delaying all releases from November 8th through the 10th due to system upgrades. Production set another record yesterday, exceeding 107 bcf, but trade took a cautious approach considering early-month reporting inconsistencies. LNG flows have also been maintained near record highs this week, helping to offset the production gains. Prices held above the 9-day moving average, keeping that level which is currently near 3.45, as initial support, followed by the 3.40 area. With the upside tested multiple times this week, significant resistance doesn’t arise until the 200-day moving average near 3.63. A settlement above there could portend a winter trend with 3.90 the next target.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.