by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded in a firm fashion following the halting of Kurdistan exports through an Iraqi-Turkish pipeline to the port of Ceyhan. The shutdown follows a ruling by the International Chamber of Commerce that Turkey should not allow Kurdish exports through Iraq -Turkey pipeline and the Turkish port of Ceyhan without approval from the Iraqi Federal Government. The exports affected total as much as 400 tb/d. Additional support was provided by the appearance of stability in the US banking sector with both stocks firm and interest rates higher following the purchase of a large portion of Silicon Valley Bank by First Citizen Bank.

The recovery in values likely reflects the appearance that in many commodity markets, the speculative froth previously apparent in many markets has come off as speculative interest move to the sidelines on a risk off mentality and fears that higher interest rates would lead to a marked weakening in demand. This has been readily apparent in the petroleum complex where in the two weeks ending March 21 hedge funds and other money managers have liquidated at the fastest rate since May, 2017. The liquidation pressure looks to have run its course which might allow valuations to reflect the adequate nearby availability while looking forward to potential tightness in the second half of 2023. With any SPR purchases likely pushed off until late this year, the market will be looking at the strength of the Chinese recovery along with how well disappearance rates hold up in the US particularly during the summer. We continue to look for a choppy bias to values with resistance near 73-74 and support near 65.00.

OPEC+ policy deliberations, especially during a full Ministerial Meeting scheduled for June, will be watched as we move into the second half of the year when the prospect for a deficit situation is expected to come into a clearer view. The OPEC Joint Ministerial Meeting scheduled for April 3rd is not expected to result in a change to production policy. The DOE report is expected to show a build in crude stocks of .2 while distillate and gasoline are expected to fall by 1.4 and 1.6 mb respectively. Refinery utilization is expected to increase by .6 percent to 89.2 percent.

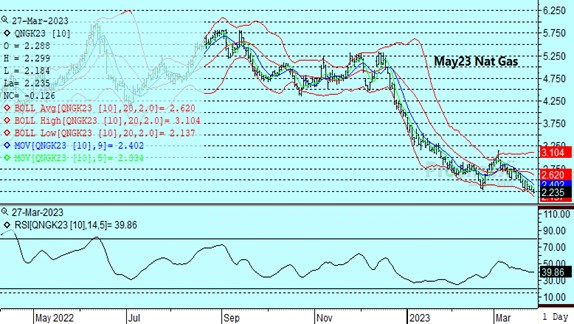

Natural Gas

High storage levels continue to undercut valuations. With demand likely to ratchet down further as we move into spring, the inventory situation is unlikely to get dramatically better production at 98.5 bcf/d remains high. The move down to new lows suggests further potentially to the 2.10-2.15 level basis May where some renewed support should develop on an oversold condition into the options expiration tomorrow and the LTD in April Nat Gas on Wednesday. The recovery in Freeport shipments despite ongoing delays should help provide better support as exports exceed 13.0 bcf/d and useage expands on the price competitiveness to coal. Given the seasonal weakness to demand any movement to the upside might be labored with initial resistance near 2.63 and possibly 2.80 basis May as seasonally weaker demand dulls interest at the higher levels. The EIA report is expected to show on Thursday, a storage draw of 52-58 bcf.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.