by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded firm with May WTI settling with a gain of 1.58 at 82.16. Products were also higher, with May gasoline settling up 3.86 cents per gallon and ULSD gaining 6.59, with both cracks continuing to trade in a steady to firm fashion. Reports of additional Ukrainian drone attacks on Russian refining facilities encouraged buying from a risk perspective. Reports that Iraq would curb oil exports to 3.3 mb/d to compensate for any rise in its OPEC+ quota in January-February was also supportive. Their production quota is currently 4 million barrels per day under the voluntary cuts and their production was as high as 4.2 mb/d in February with exports totaling 3.43 mb/d.

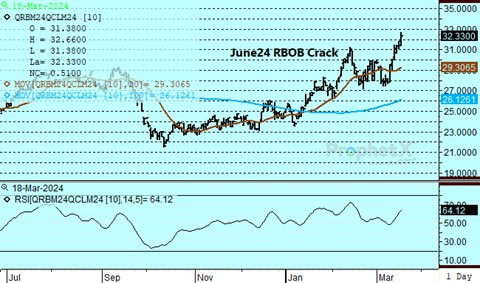

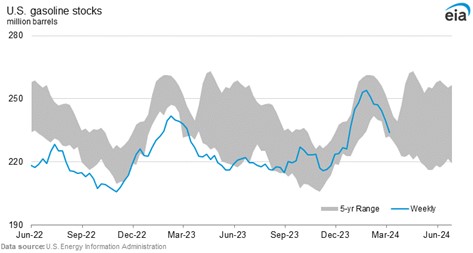

The crack spreads will remain a focal point as drone strikes on Russian refining capacity and declining US gasoline inventories remain supportive influences. With the approach of summer and increase in vacation travel, the potential exists for further upside movement in the gasoline crack. Although prices are historically high at 32.20 on the June RBOB crack, it is still well short of the highs reached in June of 2022 near 60.00, when low stocks in Europe and an embargo on Russian shipments rallied valuations sharply.

It does not appear dire, despite the drone attacks on Russian refining, as US stock levels are higher than they were in June of 2022. With refineries coming out of maintenance and new capacity coming on stream, supply is likely to meet demand but might be slow to develop at a time when Russian gasoline production could fall between 7-10 percent and crude exports pick up. Subsequently, the gasoline, or RBOB crack, could probe higher into the 38-40 area basis June before better resistance develops.

DOE report estimates point to crude inventories falling .1 mb, distillate gaining .1 and gasoline inventories drawing by 2.6 mb. Refinery utilization is expected to gain .9 to 87.7 percent.

Natural Gas

The market traded higher after weekend weather revisions saw the 15-day forecasts turn decidedly cooler. The April contract, which expires next Tuesday the 26th, added 4.8 cents to settle at 1.703, while the May gained 4.4 cents to 1.833. Despite the buying interest, prices stayed within Friday’s range and saw light volume on the rally. The higher trade again tested the 9-day moving average, which comes in at 1.884 on the May contract, but the failure to violate that level is a near term negative for the market. The contract low on the May at 1.74 is the next downside target, with minor support in the 1.78 area on the way down.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.