by market analysts Stephen Platt and Mike McElroy

Price Overview

March crude failed to trade above last week’s high of 82.66 basis March but managed to close above the 100-day moving average at 80.30 as support continued to be generated by optimism over the Chinese economy following an easing of COVID restrictions and the associated pickup in travel. Demand in India has also surged, with imports hitting a 5 month high as buying of discounted Russian crude oil remains strong. The economic optimism in Asia has encouraged buying by hedge funds and other money managers. According to the CFTC Commitment of Traders Report, they purchased petroleum futures at the fastest pace since November 2020, which was ahead of the successful COVID vaccine trials.

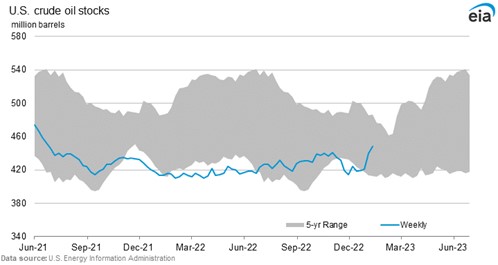

Despite the buoyant tone, some caution to the should emerge. Supply availability appears to be improving as sharp increases in US crude inventories continue. Russian availability has also improved with Urals crude loadings set to rise by as much as 50 percent in January. Although nervousness persists ahead of the product embargo and import ban by Europe and the G-7 respectively on February 5th, the seasonal pullback in demand as we move into the 2nd quarter along with improving availability from OPEC members suggests a more balanced market verging on surplus. The Chinese economic recovery will be watched closely, with travel into the Lunar New Year up but not as much as expected. Forecasts for a deficit into the last half of the year, along with the strength to refining margins, will continue to be monitored and supportive on any setbacks.

The DOE report is expected to show crude inventories building by 1.6 mb, distillate falling 1.6 and gasoline up by 2.1 mb. Refinery utilization is expected to be higher by 1.2 to 86.5 percent.

Natural Gas

A cooling in the forecasts managed to scrape up some buying interest to kick off the week, as the March contract gained 18.6 cents on the day to settle at 3.222. Although the 15-day outlooks gained in excess of 40 bcf in demand, the majority of that was in the less reliable back end of the forecasts, and did not trigger a runaway rally. With production reaching the 99 bcf/d level over the weekend and trade comfortable with current storage levels, it will take a severe or extended cold regime in February to ignite sustained buying. The market managed to settle just above the 9-day moving average, pointing to possible upside follow-through with the next target near 3.60. If the swing to colder temperatures can confirm over the next few days, the market would not encounter substantial resistance until 4.20, which marks a 38 percent retracement of the break since mid-December. A return to lower trade would find 3 dollars as solid support, and a settlement through there could make 2.50 the next target.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.