by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex fell sharply, with April crude losing 2.12 to settle at 76.49 as active selling developed in response to news that Israeli negotiators would take part in new Gaza ceasefire talks, which will take place this weekend in Paris with the US, Qatar, and Egypt. These will be the first negotiations on a ceasefire since Israeli Prime Minister Netanyahu rejected the last proposal by Hamas for a 4 ½ month truce. In addition, US sanctions announcement today did not appear to focus on Russian oil sales, but instead on financial institutions and the Mer system, along with entities providing military equipment and technology aiding Russia.

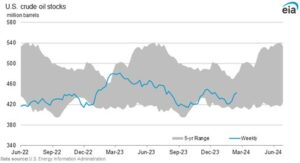

Yesterday’s DOE report showed crude inventories rising by 3.5 mb. In products, gasoline stocks fell less than expected by .3 mb while distillate lost more than expected at 4 mb. Total stocks of crude and products fell .8 mb. Domestic production was near record highs of 13.3 mb against 12.3 a year ago. Refinery utilization remained at 80.6 percent due to the Whiting refinery outage that is not expected to be rectified until early March. Total disappearance remains subdued at 18.9 mb compared to 20.2 last year. Gasoline disappearance was reported at 8.2 mb compared to 8.9 last year while distillate disappearance was indicated at 3.9 mb compared to 3.8 last year. Total net exports of crude and products reached 3.0 mb against 2.2 mb last year, with net exports 4.7 mb against at 3.9 mb in 2023.

The breakdown today was supported by weakness in the backwardation of crude spreads and could be a harbinger of further declines to the 74.00 area, particularly if progress is made on a ceasefire in Gaza. Although stocks are building, additional increases in the next two quarters are likely to be modest. A key component of the stock outlook will be decisions made at the OPEC meeting in early March and whether Russia and Saudi Arabia will attempt to scale back their voluntary production cuts for shipments in April.

Natural Gas

Strength seen at midweek could not follow through as prices retrenched over the last two sessions, losing 13.3 cents today to settle at 1.699 basis April. Despite the drop, the market managed a small gain on the week due to the announced output cuts from Chesapeake Energy. Market talk has become focused on whether this week’s action is a sign that a low has been put in. Weather is certainly not helping the cause, with demand revised lower overnight as above normal temperatures are expected throughout the 15-day forecast. Freeport LNG continues to have one train out of service with little information offered, which added a negative bias. Yesterday’s storage report came in below estimates at 60 bcf, leaving total stocks more than 22 percent above the 5-year average. With the preponderance of negative signals, any price strength will be the result of decreases in production. This week has seen steady output losses, but a more significant pullback will need to develop to tip the current balance. Today’s settlement was below the 9-day moving average, a near term negative sign with the contract lows at 1.60 the next significant level of support. 1.863 was the highest settlement on this weeks rally, and that level will need to be exceeded to signal a possible test of the 2 dollar area.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.