USDA WASDE PRODUCTION HIGHLIGHTS

Big surprises in today’s USDA data which featured another shift in soybean acres to corn.

Bearish for corn, huge production however also huge demand.

Supportive for soybeans as acreage shifts tighten stocks significantly. Record US yields to keep stocks from tightening further.

Wheat mostly neutral however prices tilting lower in sympathy with lower corn.

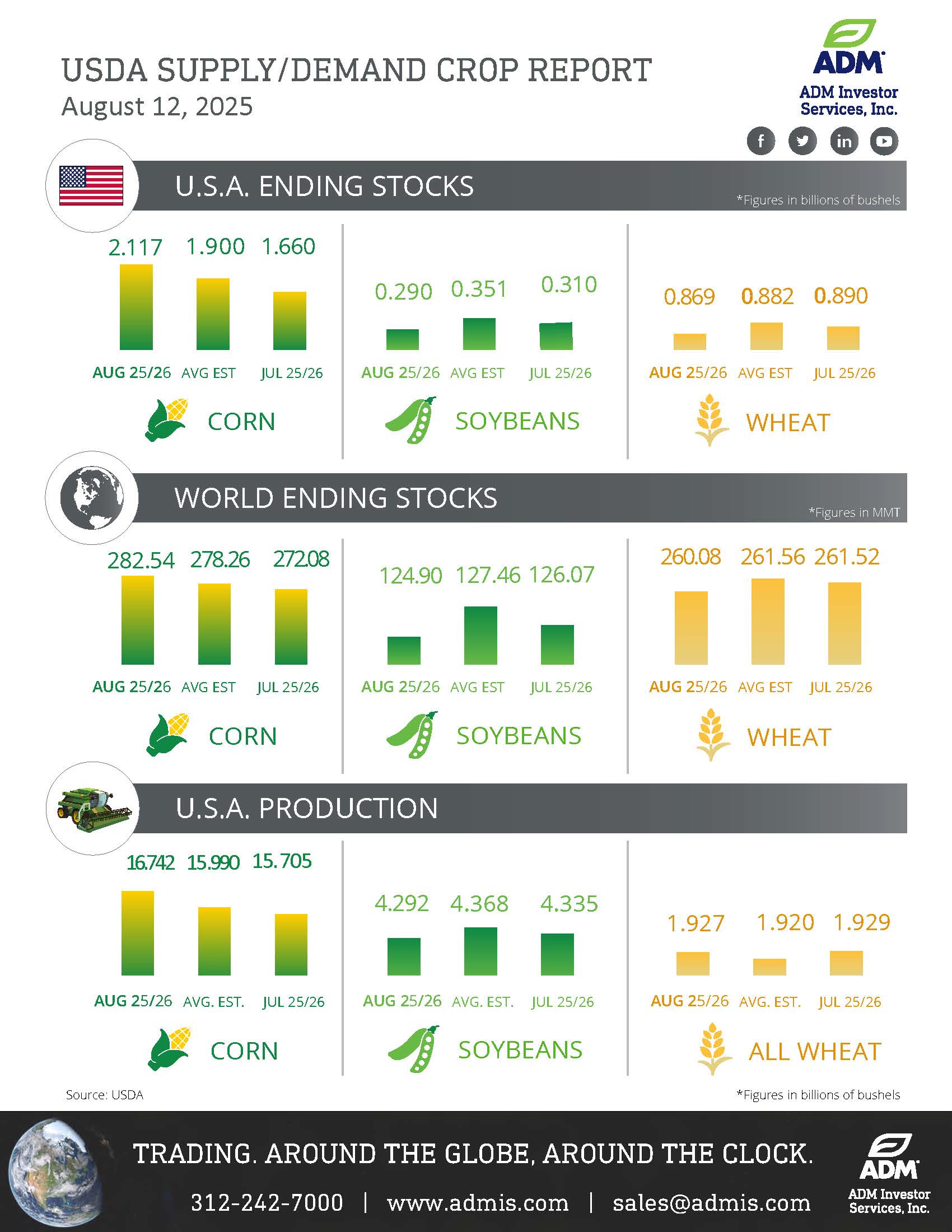

Corn:

- Old crop 24/25 ending stocks down 35 mil. to 1.305 bil. slightly below expectations

- Exports raised another 70 mil. bu. FSI usage down 35 mil.

- 2025 harvested acres up nearly 2 mil. to 88.69 mil. Ave. yield up 7.8 bpa to record 188.8 bpa

- Production up nearly 1 bil. bu. to record 16.742 bil. roughly 750 mil. above expectations

- New crop 25/26 demand up 545 mil. bu. to nearly 16 bil.

- US ending stocks just over 2.1 bil. 215 mil. above expectations

- Global stocks up 10.5 mmt to 282.5 mmt, above expectations

Soybeans

- Old crop 24/25 ending stocks down 20 mil. to 330 mil. slightly below expectations

- Exports and crush both raised 10 mil. bu.

- 2025 harvested acres down 2.4 mil. from July to 80.1 mil. Ave. yield up 1.1 bpa to record 53.6 bpa

- Production down 43 mil. bu. to 4.292 bil. roughly 75 mil. below expectations

- New crop 25/26 exports were cut 40 mil. bu.

- US ending stocks projected to fall to 290 mil. below the range of estimates

- Global stocks down 1 mmt to 125 mmt

Wheat

- All US wheat production little changed at 1.927 bil. bu.

- Winter wheat production increased 10 mil. to 1.355 bil. roughly 10 mil. above expectations

- Spring wheat production down 19 mil. to 485 mil., durum up 7 mil. to 87 mil. bu.

- Demand raised 20 mil. with exports up 25 mil. food usage down 5 mil.

- Ending stocks cut 21 mil. to 869 mil. nearly 15 mil. below expectations

- World stocks down 1.5 mmt to 260 mmt, at the low end of expectations

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.