Soybean traded near unchanged. Soyoil gained on soymeal. Corn futures also traded unchanged. Wheat traded higher. US stocks and Crude is higher. US Dollar is lower. Talk of improved chances for US stimulus is helping stocks and energies.

SOYBEANS

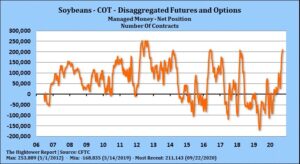

Soybeans traded near unchanged. Strong China demand for US soybeans offers support to futures. Increase US harvest and potential farmer selling offers seasonal resistance. Funds are large soybean longs and could begin to liquidate a portion of their long into Fridays USDA report. Algorithm machines continue to support the market until Brazil gets a rain. Some feel there is an increase chance for Brazil rain after Oct 10. There could be some selling in soymeal today on talk that Argentina may be more aggressive in offering soymeal for export. USDA crop report is Friday. Food and Ag Commodities Economics (Informa) estimated US 2020 soybean crop near 4,294 mil bu versus 4,313 mil bu. Their US 2020/21 soybean carryout is near 270 versus USDA 460. Weekly US soybean exports were near 61 mil bu versus 47 last week and 38 last year. Season to date exports are near 242 versus 154 last year. USDA goal is 2,125 versus 1,680 last year. Some are as high as 2,275. Managed funds are long 256,000 soybean contracts, 93,000 soymeal contract and 87,000 soyoil contracts. SX support is near 10.00. Resistance is 10.46. Trade expects USDA to keep crop rating near 64 pct good/ex and harvest near 36 pct versus 20 last week.

CORN

Corn futures traded most unchanged. Managed funds are large long in corn and have added to positions after USDA Sep 1 stocks were lower than expected. Large US export program and slow US farmer selling is offering support near season highs. The increase in US export program helps offset the slow return to US fuel demand due to Covid and ethanol production. Next market hurdle will be Fridays USDA report. Longs hope USDA will lower US 2020 crop which will tighten US 2020/21 supply. There are some that feel a tighter outlook could push futures higher post-harvest, keep basis firm and tighten 2021 spreads. Brazil will be dry until Oct 10 then rains could start to develop. Russia could be dry all of October. US Midwest will remain dry for the next 2 weeks. Argentina will be mostly dry over the next 2 weeks. Most expect US corn harvest to be near 18-21 percent done. USDA crop report is Friday. Food and Ag Commodities Economics (Informa) estimated US 2020 corn crop near 14,812 mil bu versus USDA 14,900. Their US 2020/21 corn carryout is near 1,996 versus USDA 2,503. Weekly US corn exports were near 34 mil bu versus 32 last week and 18 last year. Season to date exports are near 144 versus 79 last year. USDA goal is 2,325 versus 1,765 last year. Some are as high as 2,550. This includes 500 mil bu to China versus 80 last year. Funds are long 167,000 corn contracts. CZ support is near 3.60. Resistance is 3.90.

WHEAT

Wheat futures traded higher on talk of dry weather in Russia, US south plains and Argentina. Managed funds are increasing net longs due to the dry weather. Russia domestic wheat and flour prices remain near record high. There is talk that Russia may soon announce 2021 export quotas. USDA is expected to estimate US wheat plantings near 50 pct done versus 35 last week. Russia could be dry all of October. US south plains will remain dry for the next 2 weeks. Argentina will be mostly dry over the next 2 weeks. Russia may announce details in possible grain export quota this month. Russia domestic wheat and flour prices are near record high. Weekly US wheat exports were near 23 mil bu versus 21 last week and 17 last year. Season to date exports are near 363 versus 331 last year. USDA goal is 975 versus 965 last year. Funds are net long 43,000 Chicago wheat contracts. WZ is near 5.84. Support is near 5.70-6.00. KWZ is near 5.24. Support is near 5.00. Resistance is near 5.40. MWZ is near 5.35. Support is near 5.20. Resistance is near 5.50. USDA estimates World 2021 wheat crop near 770 mmt versus 764 last year. Russia is 78 mmt versus 73 last year. US 52 mmt versus 50 last year. Argentina 19 mmt versus 15 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.