Soybeans, soymeal and soyoil traded higher. Corn traded higher. Wheat futures managed to trade higher. US stocks were higher. Crude was higher. Positive vaccine news and improving Asia economic data offered support. Copper was higher. US Dollar was lower.

SOYBEANS

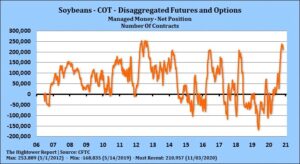

Soybean traded higher. Talk of increase China demand for US soybeans, record US NOPA October soybean crush and concern about South America weather offered support. Lack of any new US sales announced to China today offered resistance. Weekly US soybean exports were near 82 mil bu versus 56 last year. Season to date exports are near 815 mil bu versus 457 last year. USDA goa is 2,200 versus 1,676 last year. Talk of lower and late South America crops could increase US final exports to near 2,350 mil bu. This could drop US carryout below 100. There was talk that China total US soybean export commit is near 34 mmt versus goal of 38. Some feel China has bought 33-35 mmt Brazil new crop soybean to date with export goal near 55. Total China soybean imports could be 103 mmt. This suggest 2021 SA weather and crop size will be key to soybean futures prices. Some now feel Q1,2021 soybean futures could test $13.00. US October NOPA soybean crush was a record 185.2 mil bu versus 175.4 last year.

CORN

Corn futures traded higher. Talk of higher demand for US corn exports and uncertain Ukraine and Argentina weather offered support. Talk of lower US corn carryout now has some feeling CZ21 also needs to trade higher to help increase US 2021 corn acres. Managed funds have been buyers of 2,000 corn. We estimate that the funds are net long 316,000 corn contracts. Due to last week’s holiday, CFTC commit of traders report is delayed until today. Weekly US corn exports were near 32 mil bu versus 25 last year. Season to date exports are near 330 mil bu versus 196 last year. USDA goal is 2,650 versus 1,778. Talk of lower Ukraine and South America crops could increase US final exports to near 3,000 mil bu. This could drop US carryout below 1,500. Key could be China need for corn imports with reserves down and hog numbers up. Dalian corn futures are near all-time highs and $10.00. Some feel corn futures could trade over 4.50. Some rain dropped across west Argentina and central Brazil over the weekend. There is also increase chances for rain over the next 10 days for Ukraine. Some feel continued La Nina could eventually reduce rain amounts for Ukraine and South Brazil and east Argentina. Brazil second corn crop may be planted late which could help demand for US corn exports.

WHEAT

Wheat futures traded both sides of Friday’s close but managed to trade higher on the close. Wheat futures lack the big buyer of US wheat like China buying US soybeans and corn. Wheat is also a weather market. Talk of increase chances for rains in Russia offered resistance early. Some feel continued La Nina could eventually reduce rain amounts for Russia and US south plains. Managed funds have been buyers of 1,000 wheat. We estimate that the funds are net long 41,000 wheat. Due to last week’s holiday, CFTC commit of traders report is delayed until today. Weekly US wheat exports were near 305 mt. Season to date exports are near 12.0 mmt versus 11.9 last year. USDA goal is 26.5 mmt versus 26.3 last year. USDA estimates World wheat trade near 190.8 mmt versus 190.7 last year. USDA estimates World wheat end stocks at a record 320.4 mmt versus 300.7 last year. Trade estimates US winter wheat crop rated 46 pct good/ex versus 45 last week.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.