SOYBEANS

Soybeans futures ended lower. SF dropped from 14.59 to 14.23 and is near key support near 14.18. Fact US weekly soybean exports sales were lower than last week and a mostly favorable South America weather forecast is offering resistance to soybean and soymeal futures. USDA increased World 2021/22 soybean end stocks 2.3 mmt and 2022/23 8 mmt. USDA is also forecasting that 2023 SA soybean crop will increase 36 mmt from last year. At the same time they are still forecasting China 2022/23 soybean imports at 98.0 mmt vs 91.6 ly. Some doubt China soybean imports will be higher than last year.

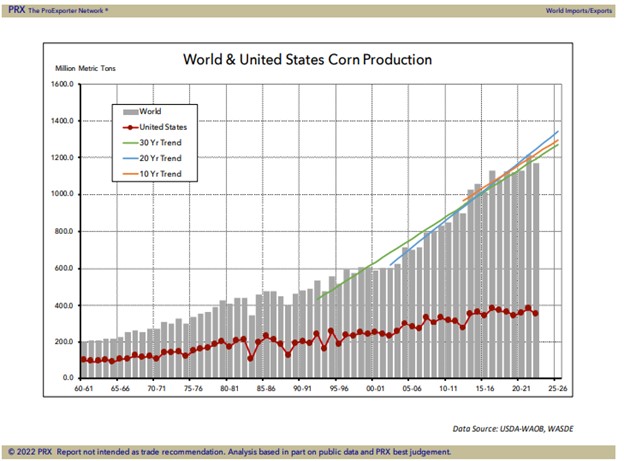

CORN

US CPI shook up the currency and equity World. Despite lower US Dollar corn futures traded lower. Overnight there was an increase in buying corn puts all the way out to Dec,23. USDA failed to address the slow pace of US corn exports. South America 2023 corn crop could be 13.5 mmt above last year. There will be a meeting Friday in Geneva about Ukraine export corridor. Other news was limited with focus on Geneva meeting and the G-20 next week, hoping something concrete will be decided for the corridor and Russian banking sanctions. Turkey wants to extend the corridor 12 months. That could be negative corn futures. Ukraine corn export price is near $257 vs US $340. Mexico is 30 pct of US corn exports. Mexico has said they will stop buying US GMO corn in 2024. Matif corn futures fell to a 10-week intra-day low close for March. The EU corn crop is down 20 mmt, but net imports are up 7 mmt in the first 4 months of the July-Jun season, which annualized would equate to 21 mmt.

WHEAT

US CPI shook up the currency and equity World. Russia wheat export price is near $320 vs US SRW $360. Weekly US wheat export sales were only 12 mil bu. Total commit is 459 vs 487 ly. USDA est Russia wheat crop near 91 mmt. Most are closer to 100. US south plains remains dry. Argentina lowered they wheat crop to 11.8 mmt vs USDA 15.5. That suggest exports closer to 5 mmt vs USDA 10. Matif wheat futures fell to a 10-week low on a higher Euro. Trade was choppy after USDA report and ahead of tomorrow’s UN/Russian Ukraine corridor talks in Geneva. Saudi and Tunisia announced tenders for tomorrow: Other news was limited with focus on Geneva meeting and the G-20 next week, hoping something concrete will be decided for the corridor and Russian banking sanctions.

See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.