SOYBEANS

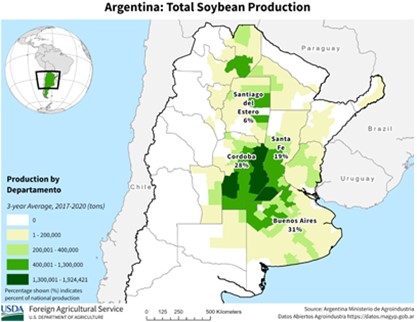

Most soybean contracts were $.03 – $.05 lower closing near the midpoint of today’s range. Trade seemed very choppy and nervous awaiting Thursday’s USDA production, stocks, and acreage reports along with a potential shift in the South American weather pattern with the weakening of La Nina. Forecasts had been gaining confidence that beneficial moisture would begin to impact Central and Northern areas of Argentina and Southern Brazil by the 2nd half of January. This is crucial to the development of later planted corn and soybeans. Weather models continue to go back and forth with rainfall amounts and precise coverage. Soybean meal finished steady to $1 lower, while soybean oil was 30 – 80 lower. The USDA did announced the sale of 174k tons (6.4 mil. bu.) of soybeans to Mexico. Dr. Michael Cordonnier maintained his Brazilian soybean forecast at 151 mt, just below the USDA’s 152 mt. He also lowered his Argentina forecast another 2 mt to 41 mt, citing dryness, lower yields, and the possibility not all intended acres would be planted. His forecast is well below the USDA’s 49.5 mt. Overnight Malaysian palm oil was down 3%. Dec-22 MPO production was slightly below expectations however was up 12% from Dec-21. End of month stocks at 1.618 mmt were below expectations however well above the 1.449 mmt from YA. The attached USDA chart illustrates the key growing areas in the driest areas of Central Argentina. I realize the maps are a bit dated however I suspect the core growing regions haven’t shifted much the past few years. Without beneficial rains soon Argentine production forecasts are likely to start falling below 40 mt.

CORN

Mch-23 corn held support near last week’s low sparking a midday turn around sending old crop contracts $.10 higher. The 50 day MA, currently $6.64 ½, capped the rally in the Mch-23 contract. Dr. Michael Cordonnier held his Brazilian corn forecast at 125 mt, just below the USDA’s 126 mt. He also lowered his Argentine forecast 1 mt to 45 mt, well below the USDA forecast of 55 mt. In their 1st estimate for Ukraine’s 2023 corn crop, UkrAgroConsult forecasts production will only reach 21.4 mt, down from 26.5 mt in 2022, and roughly half of the pre-war 2021 crop of 42.1 mt. With 20 – 30% of last year’s crop still in the field along with lack of fuel, seed, and labor all contributing to the lower forecast. If both Ukraine and Argentine production levels are slashed it puts a lot of pressure on Brazil’s 2nd corn crop along with the US to plant 92 mil. acre’s (up 3.4 mil. from 2022) as projected in the Nov-22 baseline projections. While we still expect the USDA will lower their corn export forecast by 50 – 75 mil. bu. on Thursday the window for US corn sales to pick up is rapidly approaching. Brazil is effectively out of the export market as old crop supplies dwindle. Cheaper corn from Ukraine will likely continue to flow to neighboring countries. The US should be competitive to all the rest. China? Potential demand here likely hinges on the pace of their reopening. The US export pace will have to accelerate soon or face prospects of addition 50 – 75 mil. bu. cuts every month of 2.

WHEAT

This morning’s lower trade was driven by cheap wheat being offered from the Black Sea region along with growing expectations for US winter wheat crop prospects. Both spot Chicago and KC wheat contracts had slipped to multi-month lows before recovering. CGO Mch-23 slipped to its lowest level since Sept-21. KC Mch-23 hit an 11 month low. MGEX Mch-23 fell to a 1 month low. Egypt’s recent tender for 60k tons is expected to be filled by Russia, as their offers have been $10 – $15 ton below other European suppliers. Russian prices are reported trading $306/mt FOB. US winter wheat acrage estimates appear to be growing, while both the US 6-10 and 8-14 day forecasts suggests above normal temperatures and moisture across much the US winter wheat areas. Our winter wheat acre’s forecast at 34.2 mil. is up 900k from YA, and just below the average trade est. A trendline yield of 50 bpa would in production reaching 1.335 bil. bu. the largest in 7 years. UkrAgro Consult expects Ukraine’s 2023 wheat production at 15.8 mt, down from 18.9 mt in 2022 and well below the 32.2 mt harvested in 2021, the last harvest prior to the Russian invasion. Winter wheat plantings last fall only reached 3.76 mil. hectares, down 40% from previous year.

See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.