Soybeans, soymeal and wheat traded lower. Corn traded unch. Soyoil traded higher. US stocks and gold traded higher. US Dollar was lower. Increase global political tension and lack of a vaccine against Covid weighs on commodity prices.

SOYBEANS

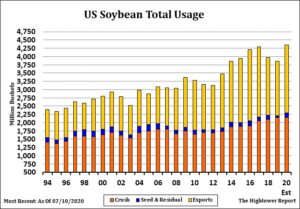

Soybean futures edged lower. September soybean futures tested the uptrend line from the May low. SU support is near 8.65. Resistance is now near 8.87. Talk of higher US 2020 supply offers resistance. There is even talk that positive profit margins this year will increase Brazil 2021 soybean acres and they could produce a record crop. China continues to buy US old crop soybean and Brazil 2021. Still to date China has only bought $6 billion US Ag goods versus $5 billion last year and $10 billion in 2014. Weekly US old crop soybean sales were near 345 mt. Total commit is near 46.9 mmt versus 48.7 last year. USDA goal is 44.9 versus 47.7 last year. New crop sales were 1.4 mmt. Total commit is near 15.1 mmt. China is 8.5. Trade guesses for US 2020 soybean crop range from 4,200-4,496 mil bu vs USDA 4,135.

CORN

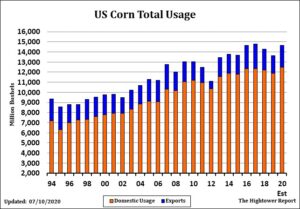

Corn futures traded quietly unchanged. This week, September corn futures made new lows after talk of favorable US Midwest weather could increase US 2020 supply. US farmers have a record amount of corn to sell in 2020. Weekly US ethanol production remains below pre-virus levels and suggest USDA demand goal may be too high. Central Midwest should see warmer temps and normal rains over the next 10 days. Parts of IA, NE, SD and SW MN could miss some of the rains. Guesses for US 2020 corn crop range from 15,036 to15,320 mil bu versus USDA 15,000. Guesses for US 202/21 corn carryout range from 2,774 to 3,400 mil bu versus USDA 2,648. Higher supplies should eventually push December corn below 3.00. Weekly US old crop corn sales were near 101 mt. Total commit is near 43.7 mmt versus 49.9 last year. USDA goal is 45.0 versus 52.4 last year. New crop sales were 2.6 mmt. Total commit is near 10.9 mmt. China is 5.7. China sold 4 mmt of corn from their reserve. Prices were below local cash prices. It will take large increases in US fuel demand, export demand or a lower than expected US 2020 crop to push prices higher. Managed funds continue to add to their net corn futures short position.

WHEAT

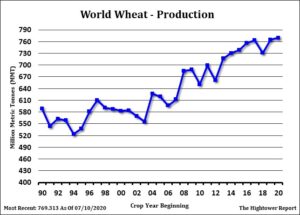

Wheat futures continue to freefall from the July higher. Talk of higher US, Russia, Canada and Australia 2020 supplies weighs on prices. Lower corn prices could also reduce demand for feed wheat. September Chicago wheat is testing 5.00 support. Contract lows are near 4.70. KC September wheat made new lows. Next support is near 4.00. Minneapolis September wheat also made new lows and traded below 5.00 for the first time since 2016. Talk that Russia could produce a 80 mmt crop with 35-37 mmt exports has offered resistance to prices. A private forecast of the 2020 Canada crop near a record 39 mmt added to futures weakness. A better than average Australia crop also offers resistance. All of this will offset talk of lower French crop and French exports. World wheat buyers are also reducing buying due to drop in revenues. Weekly US wheat export sales were near 605 mt. Total commit is near 10.2 mmt versus 9.3 last year. USDA goal is 25.8 versus 26.2 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.