Soybeans, soymeal and soyoil traded higher. Corn and wheat traded lower. US Stocks were sharply lower. Crude was lower. US Dollar was higher today.

SOYBEANS

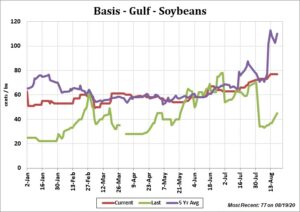

Soybean traded higher and found support on continues talk of tight old crop Brazil and Argentina soybean supply. Some even feel Brazil could hold back their soybean, soymeal and soyoil supplies for domestic use until their 2021 harvest. Managed funds are net bought 8,000 soybeans, 4,000 soyoil, and 1,000 soymeal. We estimate Managed funds are net long 257,000 soybeans, 100,000 soymeal and 91,000 soyoil. Weekly US soybean exports were impressive at 98 mil bu versus 85 last week and 58 last year. China shipped 65.4 mil bu. Season to date exports are near 527 mil bu versus 297 last year. USDA goal is 2,200 versus 1,676 last year. Some are closer to 2,350 which could drop US 2020/21 carryout closer to 175 versus USDA 290. USDA announced sales of 135 mt soybean meal to Philippines and 120.7 mt soybeans to Unknown under the daily reporting system. China will have their outlook conference this week. Most feel they will announce new spending for infrastructure which could increase their imports of base metals and raw materials.

CORN

Corn futures closed slightly lower. Rains in Brazil and Argentina should help corn and soybean plantings there. Talk of higher demand for US corn exports continues to offer support. Lack of US farmer selling corn also offers support. Some feel US farmer is only 35-45 pct harvest corn sold to date. Managed funds are net sold 2,000 corn. We estimate Managed funds are net long 251,000 corn. Trade estimates that 73 pct of the US corn crop harvested versus 60 last week and 57 average. Weekly US corn exports were at the low end of expectations at 25 mil bu. Cumulative 2020-21 US corn exports total 240 mil bu vs 137 mil bu last year. Some feel US corn exports could reach 2,600 mil bu versus USDA guess of 2,325. This could drop US 2020/21 carryout closer to 1,770 mil bu versus USDA guess of 2,167. Early guess for US 2021/22 corn crop is near 15,310 mil bu. Total demand is estimated near 15,125 mil bu versus 14,575 this year suggest a carryout near 2,000 mil bu. This should be adequate but given the demand outlook, a crop of 15,310 mil bu is needed to keep prices from moving higher. China will have their outlook conference this week. Most feel they will announce new spending for infrastructure which could increase their imports of base metals and raw materials.

WHEAT

Wheat futures traded lower. Rains/snow in parts of US south plains and forecast of rains across Russia and Ukraine dry areas offered resistance to prices. Higher US Dollar offers resistance. There was concern about increase cases of Covid in US and globally could lower demand for wheat/food. 40 pct of US domestic Wheat flour use is in restaurants. Losing that demand again could lower wheat use. Managed funds sold 6,000 wheat. We estimate Managed funds are net long 45,000 wheat. Weekly US wheat exports were 13 mil bu and in line with expectations, bringing cumulative inspections to 405 mil bu vs 390 mil bu last year. USDA is forecasting 2020-21 US wheat exports near 975 mil bu versus 965 last year. USDA estimates US HRW 2020/21 exports near 401 versus 376 last year, SRW exports near 80 mil bu versus 92 last year and 270 mil bu HRS exports versus 268 last year. USDA est US HRW 2020/21 carryout near 334 versus 506 last year, SRW carryout near 102 mil bu versus 105 last year and HRS carryout near 288 versus 280 last year. Trade estimates US winter wheat planting is estimated at 86 pct complete, and USDA first winter wheat 2021 crop ratings at 50 pct good/ex.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.