Soybeans, soymeal, soyoil, corn and wheat traded higher. US stocks were sharply higher. Crude was higher. Gold was higher. US Dollar was lower today.

SOYBEANS

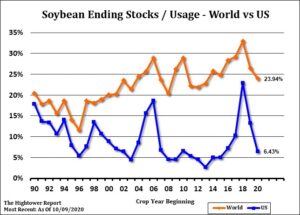

Soybean traded higher on hopes for new US soybean sales to China and concern about a drier S Brazil and E Argentina weather pattern. USDA estimated that 87 pct of the US soybean crop was harvested versus 83 average and 57 last year. One private group estimated US 2020 soybean crop at 4,183 mil bu versus USDA October guess of 4,268. This would suggest a yield near 50.8 versus USDA 51.9. It is rare that USDA would drop a November corn yield as much as this group suggest but this is a crazy year. Given slower US harvest pace some would expect the final soybean crop may not drop as much as this private guess. Still, 85 mil bu drop in the crop could reduce USDA 290 mil bu carryout the same. Some would even add 150 mil bu to US soybean export which could drop carryout even more. Same group dropped World soybean crop 4.0 mmt due to a 3.0 mmt drop in US and 1 mmt drop in Argentina.

CORN

Corn futures traded higher and Dec traded back over 4.00. Some feel talk of lower US 2020 corn crop and higher export demand could offset concern about lower Food and fuel demand as Covid cases rise and concern about increase volatility after todays US election. Managed funds were net buyers of 3,000 corn. We estimate Managed funds are net long 219,000 corn. US Midwest 2 week forecast calls for normal to above temps and below normal rains. There continues to be signs that over the next 2 weeks South Brazil and Argentina rainfall will be less than normal. One private group estimated US 2020 corn crop at 14,502 mil bu versus USDA October guess of 14,722. This would suggest a yield near 175.7 versus USDA 178.4. It is rare that USDA would drop a November corn yield as much as this group suggest but this is a crazy year. Given quick US harvest pace some would expect the final corn crop to be smaller than latest USDA guess. USDA estimated that US corn harvest is 82 pct done versus 69 average and 49 last year. 220 mil bu drop in the crop could reduce USDA 2,167 mil bu carryout the same. Some would even add 235 mil bu to US corn export which could drop carryout even more. Same group dropped World corn crop 13.6 mmt due to a 7.9 mmt drop in US and 4 mmt drop in EU and 1 mmt drop in Ukraine.

WHEAT

Wheat futures traded mixed. WZ traded unchanged and near 6.08. KWZ traded higher and near 5.57. MWZ traded lower and near 5.52. Paris wheat futures traded higher. Black Sea futures were mixed. Talk of drier 2 week Russia weather and lower US Dollar offered support. There is concern about increase volatility post US election but today US stocks and commodities traded higher. There is also concern about a drier South America and US south plains weather outlook. Managed funds are net buyers of 1,000 wheat. We estimate Managed funds are net long 42,000 wheat. One private group that dropped US and World corn and soybean supplies dropped World 2021 wheat crop 4 mmt. This due to a 2 mmt drop in Russia and 2 mmt drop in Ukraine. Their Russia crop estimate is near 75 mmt versus 83 last year. US winter wheat crop is rated 43 pct good/ex versus 41 last week and 57 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.