Soybeans, soymeal and soyoil traded lower. Corn futures closed mixed. Wheat futures traded higher. US stocks were higher. US Dollar, Crude and Gold were mixed to lower. There is still concern about commodity demand as cases of Covid increase in US and EU.

SOYBEANS

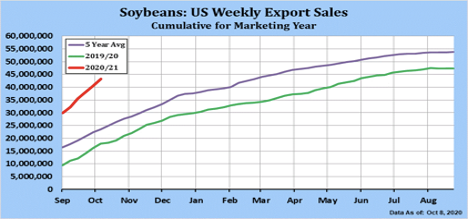

Soybean traded lower. Could be some long liquidation going into the weekend. Talk of Brazil and Argentina rains may have offered resistance. Noon weather maps were drier for north Brazil. Brazil could soon announce they will temporarily drop their 8 pct import tax on corn and soybeans. Problem is that US gulf elevations may be maxed out. Weekly US soybean export sales were 2.63 mmt. Total commit 43.2 vs 17.8 ly. China sales 1.6 mmt. Total commit 23.7 with 10.6 in unknown. USDA announced 175 mt US soybean unknown and 216 mt soybean previous. USDA goal is 59.8 mmt versus 45.6 last year. US could see increase soybean exports if Brazil 2021 harvest is delayed FACE (Informa) est 2021 US soybean acres at 89.1 vs 83.1 this year. FACE also estimated US 2021 soybean crop near 4,590 mil bu versus 4,268 this year. This assumes a yield of 52.0 versus 51.9 this year. There is concern about global soymeal supply versus demand. USDA est World soybean crush near 322.4 mmt versus 308.7 last year. US is 63.0 mmt versus 62.0 last year, Brazil 48.1 versus 46.5 and Argentina 49.2 versus 46.1. World soymeal traded is estimated near 67.8 mmt versus 66.2 last year. Argentina 29.0 versus 26.7. Brazil 16.8 versus 17.5 and US 12.2 versus 12.6.

CORN

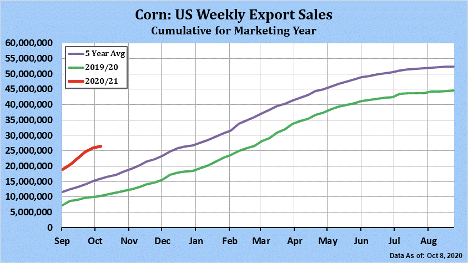

Corn futures traded mixed. CZ was near 4.02 down 1 cent and CZ21 was up 1 cent and near 3.96. Managed funds were early buyers of 3,000 corn. We estimate Managed funds are net long 205,000 corn. Talk of rains in Brazil and Argentina may have offered resistance. Noon Brazil maps were drier. Brazil could soon announce they will temporarily drop their 8 pct import tax on corn and soybeans. Problem is that US gulf elevations may be maxed out. Corn spreads have narrowed on increase export demand and slow farmer selling. Weekly US corn export sales were 655 mt. Total commit 26.5 vs 10.3 ly. China commit 10.1 mmt with 3.7 in unknown. Some Feel China may take 24 mmt of US corn. There is talk that Ukraine may have sold 8 mmt to China. USDA announced 175 mt US corn sold to Mexico. USDA goal is 59.0 mmt versus 45.1 last year. USDA estimates World corn trade near 184.7 mmt versus 170.5 last year. Brazil is 39.0 versus 34.0 last year. Argentina is 34.0 versus 38.0 last year. There is concern about global corn supply versus EU demand. USDA estimates EU imports at 24.0 mmt versus 19.0 last year. Ukraine crop could be lower and they may have sold most of their export corn to China. FACE (Informa) est 2021 US corn acres at 92.0 vs 91.0 this year. Some are at 95.0. They estimated the 20210 corn crop at 15,310 mil bu versus 14,722 this year. This assumes a yield of 181.0 versus 178.4 this year.

WHEAT

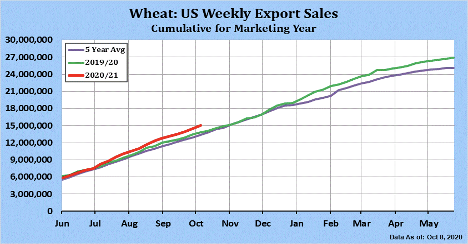

Wheat futures traded higher. Drier US south plains and Russia weather maps plus Rumors of China interest in US wheat helped rally prices. Paris wheat and CME Black Sea futures continue to make new highs. Concern about Russia weather and crop conditions has slowed Russia farmer selling and reduce flow to export ports. Some vessels are delayed loading. Managed funds were net buyer of 8,000 wheat. We estimate Managed funds to be long 54,000 wheat. Weekly US wheat export sales were 528 mt. Total commit 15.0 vs 13.8 ly. USDA goal is 26.5 mmt versus 26.3 last year. USDA estimates World trade near 189.9 mmt versus 190.5 last year. Russia is 39.0 mmt versus 34.5 last year, Canada 25.0 versus 24.6, EU 25.5 versus 38.4, Australia 19.0 versus 9.5 and Argentina 13.0 versus 13.5. FACE (Informa) est 2021 US wheat acres at 46.3 vs 44.3 last year. 2021 crop of 1,945 mil bu versus 1,826 last year. FACE (Informa) est 2021 US winter wheat acres at 31.6 vs 30.5 last year. 2021 crop of 1,253 versus 1,171 last year. FACE (Informa) est 2021 US spring wheat acres at 12.8 vs 12.2 last year. 2021 crop of 616 versus 586 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.