Morning Outlook

USDA report day. Grains are higher. SF is up 4 cents and near 11.14. SMZ is near 385.4. BOZ is near 35.59. New highs for soybean and soyoil. CZ is up 3 cents and near 4.10. WZ is up 1 cent and near 5.99. KWZ is unchanged and near 5.52. US stocks are mixed. Dollar is higher. Crude is higher. Gold is higher.

USDA will revise US/World supply and demand today. Average trade guess for US 2020 corn crop is 14,659 mil bu versus USDA Oct 14,722. One est is near 14,502. Average trade guess for US 2020/21 corn carryout is 2,033 mil bu versus USDA Oct 2,167. One est is near 1,701.

Average trade guess for US 2020 soybean crop is 4,251 mil bu versus USDA Oct 4,268. One est is near 4,183. Average trade guess for US 2020/21 soybean carryout is 235 mil bu versus USDA Oct 290. One est is near 78.

Average trade guess for US 2020/21 wheat carryout is 881 mil bu versus USDA Oct 883. What if USDA does not drop World/Black Sea wheat crop estimates?

US corn harvest is 91 pct vs 80 average, soybeans 92 vs 90 average, winter wheat rated 45 pct good/ex. US Midwest and south plains weather forecast is dry and warm. Weekly US soybean exports better then expected. Corn and wheat lower than expected. Matif corn prices near 2 week highs. Domestic corn supplies down. Matif wheat futures higher. Higher EU wheat feed demand could reduce wheat exports. Russia domestic wheat and flour prices all-time highs.

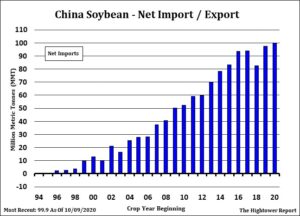

China October soybean imports 8.7 mmt. Season total 101. Low vegoil supplies and higher demand for soymeal helping absorb record imports. Brazil soybean plantings near 54 pct versus 52 average. Talk of replanting due to dry soils. Rains possible in central Brazil next week.

On Monday, Managed funds were net sellers of 3,000 contracts of SRW Wheat; bought 6,000 Corn; bought 7,000 Soybeans; bought 1,000 Soymeal, and; net bought 1,000 lots of Soyoil. We estimate Managed Money net long 41,000 contracts of SRW Wheat; long 307,000 Corn; net long 245,000 Soybeans; net long 91,000 lots of Soymeal, and; long 100,000 Soyoil.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.