TODAY—WEEKLY EXPORT INSPECTIONS—CROP PROGRESS/CONDITION REPORTS

Overnight trade has SRW Wheat up roughly 8 cents, HRW up 6; HRS Wheat up 8, Corn is up 4 cents; Soybeans up 4; Soymeal up $5.00, and Soyoil down 40 points.

For the week, SRW Wheat prices were up roughly 32 cents; HRW up 23; HRS up 16; Corn was up 7 cents; Soybeans down 15; Soymeal up $2.00, and; Soyoil down 100 points. Crushing margins were up 1 cent at $1.09; Oil share was unchanged at 31%.

Chinese Ag futures (January) settled up 167 yuan in soybeans, up 40 in Corn, up 20 in Soymeal, down 58 in Soyoil, and down 84 in Palm Oil.

Malaysian palm oil prices were down 98 ringgit at 2,772 (basis January) following rival vegoils, concerns over slowing import demand from India and others.

U.S. Weather Forecast: The 6 to 10 day forecast for the Midwest has widespread rains to fall across the region with a system to occur later Sunday into Monday of next week. Rainfall totals look moderate with 100% coverage. Temps over the next 6 to 10 days look to mostly be running below average with some average to above average in the far east. The Southern Plains over the 6 to 10 day period has light to moderate rainfall in the eastern half of KS, OK, and TX with possible lighter amounts in the west. Temps will run above average for most of the week before falling to below average for the weekend and early next week.

South America Weather Forecast: The Brazilian growing regions has light to moderate rainfall covering 75% of the area in the north with things quiet in the south. The 6 to 10 day has moderate rainfall for 80% of the growing regions. The Argentine growing regions has moderate rainfall for most areas the first half of the week before turning dry the remainder of the week. The 6 to 10 day models are mixed with the GFS seeing widespread rainfall whereas, the European sees little rainfall in Buenos Aries with light to moderate rainfall in the rest of the growing areas.

Europe/Black Sea Region Forecast: Europe weather will be drier biased this week in the eastern half of the continent, including Ukraine; Western Europe will trend wetter in the second half of this week after a relatively dry start to the week. Long-awaited rains arrived in part of Russia’s winter wheat-sowing regions over the weekend after dry weather, the head of the IKAR agriculture consultancy said; more rains are still needed in these regions; farmers in part of Russia have been sowing winter wheat in dry soil this autumn which signals risks for the 2021 grain crop.

The player sheet had funds net buyers of 3,000 SRW Wheat; net sold 2,000 Corn; sold 10,000 Soybeans; sold 4,000 Soymeal, and; net sold 1,000 Soyoil.

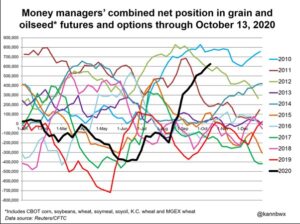

We estimate Managed Money net long 60,000 contracts of SRW Wheat; long 207,000 Corn; net long 232,000 Soybeans; net long 86,000 lots of Soymeal, and; long 78,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 3,600 contracts; HRW Wheat down 440; Corn up 12,900; Soybeans down 9,100 contracts; Soymeal down 2,600 lots, and; Soyoil down 2,000.

There were no changes in registrations—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 361; Soybeans 1; Soyoil 1,907 lots; Soymeal 250; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Ethiopia seeks 280,000t optional-origin wheat—Syria needs up to 200,000t of wheat per month to meet shortfall—

For the week ended October 8th, U.S. All Wheat sales are running 9% ahead of a year ago, shipments up 6% with the USDA forecasting a 1% increase on the year.

For the week ended October 8th, U.S. Corn sales are running 156% ahead of a year ago, shipments 70% ahead with the USDA forecasting a 31% increase.

For the week ended October 8th, U.S. Soybean sales are running 142% ahead of a year ago, shipments up 86% with the USDA forecasting a 31% increase on the year.

Damage estimates from a rare wind storm that slammed Iowa and some other parts of the Midwest in August are growing, with the total now at $7.5 billion, according to a new report; the Aug. 10 storm hit Iowa hard but also caused damage in Illinois, Ohio, Minnesota and Indiana; the National Oceanic and Atmospheric Administration said it’s currently the second-costliest U.S. disaster so far in 2020, although cost estimates for widespread wildfires along the West Coast aren’t yet available.

Speculators have been flirting with record optimism in Chicago-traded soybeans for a couple of weeks, though they finally broke their bean-buying streak last week as futures hit 2-1/2-year highs. However, investors’ bullish corn run is still alive.

China’s third-quarter pork production rose 18% from a year earlier to 8.4 million tons, according to Reuters calculations based on official data, pointing to the first signs of recovery in the world’s top producer; it was the first quarter since July-September of 2018 to show a year-on-year increase in pork output, after an epidemic of African swine fever swept through the country’s hog herd, causing production to plunge.

Brazil will suspend tariffs on corn and soy imports from countries outside the Mercosur trade bloc until early next year to help reduce food prices that are pushing up inflation, the economy ministry said on Saturday; the decision to remove the tariffs temporarily was taken late on Friday at a meeting of Gecex, a technical body within the economy ministry; soybean meal and soy oil imports will also be exempt along with soy imports until Jan. 15, 2021, while corn imports will cease paying the tariffs until March 31, 2021; both measures are aimed at containing high prices for food.

Workers at a meat plant in southern Brazil accepted a 2.05% pay rise offer made by Brazil’s BRF SA, averting the risk of a strike at the company’s massive turkey and chicken processing facility in the southern town of Chapecó, a union leader said; BRF confirmed acceptance of its offer after it was put to a workers’ vote this afternoon, but did not go into detail.

Livestock suppliers in Brazil are producing more while using less land, as concerns mount about straining natural resources to produce food to feed a growing world population, the global chief executive of the world’s largest meatpacker JBS SA, said; in remarks made during a panel discussion to mark World Food day, meat production in Brazil tripled on a per hectare basis between 1990 and 2019; last month, JBS launched a 1-billion real fund to foster social and economic development in the Amazon, an initiative that the company says will help support local communities while also ensuring livestock production does not destroy the rainforest.

Russia’s October exports of wheat, barley and maize (corn) are estimated at 4.85 million tons, down from 5.65 million tons in September, the SovEcon agriculture consultancy said.

Ukraine has harvested 45.7 million tons of grain from 12.06 million hectares, or 78% of the sown area, Ukraine’s economy ministry said; it said farmers had collected 10.0 million tons of corn from 2.2 million hectares, or 40% of fields planted with this crop; Ukraine reported in late September that it had completed wheat and barley harvest whose output had declined to about 25.1 million tons and 7.8 million tons respectively from 28.3 million tons and 8.9 million tons in 2019.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.