TODAY—WEEKLY DELIVERABLE STOCKS —

Overnight trade has SRW Wheat down roughly 3 cents, HRW down 4; HRS Wheat down 2, Corn is down 1 cent; Soybeans down 4; Soymeal down $0.50, and Soyoil down 55 points.

Chinese Ag futures (May) settled down 12 yuan in soybeans, down 20 in Corn, up 4 in Soymeal, down 70 in Soyoil, and down 24 in Palm Oil.

Malaysian palm oil prices were down 31 ringgit at 3,361 (basis February) weighed by lower crude oil prices.

South America Weather Forecast: In Brazil, conditions will be favorable in much of the nation for crop development; though, a little concern remains of drier than preferred conditions in western Mato Grosso do Sul. This area will be notably dry through Friday before greater rain occurs this weekend into next week which will be welcomed. The 6 to 10 day sees good rainfall in most of the growing regions. Temps seen average in the north, average to a bit below in the south.

In Argentina, concern remains of increasing dryness in the southern part of the nation in the next two weeks, especially in localized areas. Some shower and thunderstorm activity will occur occasionally; though, much of the rain will likely be erratic. Southern Argentina will receive some rain Thursday from a frontal boundary and Sunday into next Monday from another frontal boundary and this rain will at least help protect crops some from potential dryness in week 2 of the outlook. The first front looks to see light amounts of rainfall with 45% coverage, the second front light to moderate rainfall with 85% coverage. Temps below average over the next 10 days.

The player sheet had funds net buyers of 2,000 contracts of SRW Wheat; bought 15,000 Corn; net even in Soybeans; net sold 1,000 lots of Soymeal, and; net sold 2,000 lots of Soyoil.

We estimate Managed Money net short 2,000 contracts of SRW Wheat; long 287,000 Corn; net long 197,000 Soybeans; net long 66,000 lots of Soymeal, and; long 115,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 1,400 contracts; HRW Wheat down 2,300; Corn down 2,300; Soybeans up 4,900 contracts; Soymeal up 2,200 lots, and; Soyoil down 1,000.

Deliveries were ZERO Soymeal; ZERO Soyoil; ZERO Corn; ZERO HRW Wheat; ZERO Oats; 12 SRW Wheat, and; ZERO HRS Wheat.

There were changes in registrations (SRW Wheat down 33; Soyoil down 5)—Registrations total 175 contracts for SRW Wheat; 78 Oats; Corn 1; Soybeans 175; Soyoil 1,425 lots; Soymeal 193; Rice 313; HRW Wheat 113, and; HRS 1,083.

Tender Activity—Japan seeks 131,300t optional-origin wheat—S. Korea bought 69,000t optional-origin corn—Iran seeks 30,000t optional-origin sunoil–

The United States on Monday imposed financial sanctions and a travel ban on 14 Chinese officials over their alleged role in Beijing’s disqualification last month of elected opposition legislators in Hong Kong. The move, which was first reported by Reuters overnight and sent Asian stock markets lower, targeted the vice chairpersons of the National People’s Congress Standing Committee (NPCSC), the top decision-making body of the Chinese legislature. The action was widely seen as part of an effort by outgoing President Donald Trump to cement his tough-on-China legacy and also box president-elect Joe Biden, before he takes office on Jan. 20, into hardline positions on Beijing at a time of bipartisan anti-China sentiment in Congress.

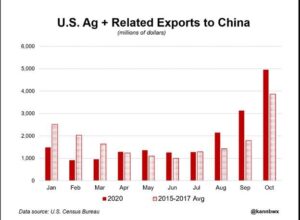

China is so hungry for soybeans that it’s started buying U.S. supplies from next year’s crop much earlier than usual. The world’s top importer has been picking up American cargoes over the past week, according to people familiar with the matter, who asked not to be identified because the trades are private. While buyers bought fewer than five cargoes, purchases came earlier than the usual end of the first quarter. China is loading up on U.S. crops from corn to soybeans to feed a hog population that’s recovering from African swine fever, a deadly pig disease, much faster than traders and analysts expected. The Asian nation’s economy is also recovering from the coronavirus pandemic, helping boost demand for food.

Yesterday’s U.S. weekly export inspections had

—Wheat exports running 3% ahead of a year ago (1% last week) with the USDA currently forecasting a 1% increase on the year

—Corn 69% ahead of a year ago (up 68% last week) with the USDA up 49% for the season

—Soybeans are up 69% on the year (up 78% last week) with the USDA having a 31% increase forecasted on the year

U.S. soybean export prices have recently topped six-year highs, which in theory would help China meet its agricultural trade promises to the United States in a speedier fashion. The rally has indeed padded the export values, but they have been far less impactful than the enormous volumes of U.S. soybeans that have sailed to the Asian country in recent months. The Phase 1 trade deal calls for China in 2020 to import a record dollar value of U.S. agricultural products, even more than in 2012 or 2013, which featured some of the highest commodity prices ever observed, well above today’s levels.

US ethanol inventories are expected to keep growing this week, a reflection of the higher coronavirus case count in the US. Ethanol inventories, already at their highest levels since mid-June at 21.24M barrels, are expected to rise another 150,000 to 250,000 barrels. The increase in ethanol inventories would accompany new restrictions certain states have placed in an effort to stem the new tide of Covid-19 cases hitting hospitals– which in turn are expected to cut into demand for fuel.

China said on Monday it had suspended imports of beef from Australia’s Meramist Pty Ltd, the sixth supplier to face such a move in a country that is one of China’s main meat suppliers. China, which did not say why it took the latest decision, has already banned imports from five other Australian beef suppliers this year, citing reasons that have included issues with labelling and health certificates.

Growth of beef imports by China will slow to less than 20% next year, a leading industry analyst said on Tuesday, amid lower supplies from key exporter Australia and as the country boosts domestic pork production. China, which accounts for a quarter of the global beef trade, has rapidly expanded its beef imports in recent years, with shipments up 60% last year to 1.66 million tonnes and up 40% this year to date.

Brazilian farmers had planted 90% of the area expected to be sown with the oilseed as of Dec. 3, according to agricultural consultancy AgRural. That was up from 87% a week earlier, and behind the 93% planted on the same day a year ago.

Russian wheat export prices fell slightly last week amid healthy supply from domestic farmers, analysts said on Monday. Russian wheat with 12.5% protein loading from Black Sea ports for supply in December was at $252 a tonne on a free-on-board (FOB) basis at the end of last week, down $2 from the week before, the IKAR agriculture consultancy said; Sovecon, another agriculture consultancy in Moscow, said wheat and barley were steady at $255 and $216 a tonne, respectively.

Ukraine’s grain exports have fallen to 22.3 million tonnes so far in the season that runs from July 2020 to June 2021 from 26.3 million tonnes in the same period last season, the economy ministry said on Monday. Traders had sold 6.1 million tonnes of corn as of Dec. 7, down from 8.6 million tonnes on the same date last year. The volume of exported wheat had shrunk to 12.1 million tonnes from 13.8 million tonnes.

Ukraine has reported an outbreak of highly pathogenic bird flu among backyard birds in the southern part of the country, the World Organisation for Animal Health (OIE) said. Avian influenza, commonly called bird flu, has been spreading rapidly in Europe, putting the poultry industry on alert after previous outbreaks led to the culling of tens of millions of birds.

Soft wheat exports from the European Union and Britain in the 2020/21 season that started in July had reached 10.44 million tonnes by Dec. 6, official EU data showed; tat was 21% below the volume cleared by the same week last year.

—EU and UK 2020/21 barley exports had reached 3.23 million tonnes, down 12%

—Maize imports stood at 7.23 million tonnes, down 23%.

Soybean imports into the European Union and Britain in the 2020/21 season that started on July 1 totalled 6.22 million tonnes by Dec. 6, official EU data showed; tat was 1% below the volume imported in the previous 2019/20

France’s farm ministry on Tuesday estimated the country’s winter soft wheat area for the 2021 harvest at 4.73 million hectares (mln ha), up 12.4% compared with the previous year. In its first sowing estimates for next year’s harvest, the ministry pegged the winter barley area at 1.26 mln ha, up 6.6%. For winter rapeseed, France’s main oilseed crop, the ministry estimated that the area would reach 1.13 mln ha, up 1.0% on the area harvested in 2020.

European wheat futures fell on Monday to touch a two-month low, pressured by improving global supply prospects and strength in the euro, before trimming losses as Chicago futures rose and a chart floor in Paris held. March was down 1.0 euro, or 0.5%, at 201.00 euros ($244.0) a tonne. It earlier slid to 199.00 euros, its weakest level since Oct. 9, as it extended a recent slide into a seventh consecutive session.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.