TODAY—WEEKLY EXPORT SALES—HOGS AND PIGS—

Overnight trade has SRW Wheat down roughly 6 cents, HRW down 5; HRS Wheat down 3, Corn is down 5 cents; Soybeans down 12; Soymeal down $3.50, and Soyoil down 60 points.

Chinese Ag futures (January) settled up 1 yuan in soybeans, down 15 in Corn, down 6 in Soymeal, down 174 in Soyoil, and down 172 in Palm Oil.

Malaysian palm oil prices were down 62 ringgit at 2,799 (basis December) at midsession, a two week low as weaker rival vegoils, rising output, and political uncertainty weighed on the market.

U.S. Weather Forecast: The 6 to 10 day forecast for the Midwest will see a front working through Monday into Tuesday bringing light to moderate rainfall mostly favoring the northeast Midwest. Temps will be above average over the next 4 to 5 days but, with those fronts, temps will be falling to below average early next week. The Southern Plains over the 6 to 10 day period sees little to no rains for most of the region. Temps will be above average over the next 4 to 5 days falling to average in the west and below average in the east towards the later end of the 10 day period. The Delta has mainly dry weather to dominate most areas over the 6 to 10 day period.

South America Weather Forecast: The weather outlook in most production regions is unchanged; showers and a few thunderstorms are still expected in center west and center south Brazil over the near term which will begin to moisten the topsoil moisture a little; greater rainfall will be needed though to promote better flowering conditions. Seasonal showers normally begin in center-south and center-west Brazil during the second half of September. This week’s scattered showers were thought of as being the start of seasonal precipitation. However, a drier than usual weather pattern is expected over the next ten days to two weeks and could last a little longer.

Europe/Black Sea Region Forecast: The forecast has not changed with most of the European continent getting rain at one time or another during the next two weeks. The moisture boost will prove favorable for winter crop planting in many areas. Relief in parts of Ukraine from dryness will help improve winter crop planting conditions, although more rain will be needed.

The player sheet had funds net sellers of 8,000 contracts of SRW Wheat; net sold 1,000 Corn; sold 4,000 Soybeans; bought 4,000 Soymeal, and; net sold 5,000 Soyoil.

We estimate Managed Money net long 20,000 contracts of SRW Wheat; long 65,000 Corn; net long 219,000 Soybeans; net long 67,000 lots of Soymeal, and; long 86,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 470 contracts; HRW Wheat down 1,600; Corn up 6,500; Soybeans down 4,000 contracts; Soymeal down 2,600 lots, and; Soyoil down 260.

There were no changes in registrations—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 222; Soybeans 1; Soyoil 1,907 lots; Soymeal 300; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Japan bought 86,000t U.S./Canadian wheat—

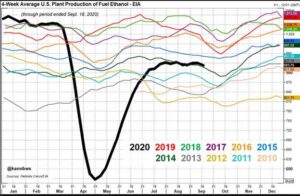

U.S. ethanol production for the week ended September 18th averaged 906,000 barrels per day (down 2.16% versus a week ago, down 3.92% versus a year ago); stocks totaled 19.997 mil barrels (up 1.01% versus a week ago, down 11.12% versus last year); corn use for the week was 89.9 mil bu (91.7 mil last week) and versus the 98.1 mil bu needed to meet USDA projections.

U.S. ethanol production last week sank to a 12-week low, but the running deficit versus previous years has been shrinking over the last month, bringing output slightly closer to normal levels; implied ethanol consumption is off from recent highs, but its year-on-year deficit has also contracted; U.S. gasoline demand is declining in line with seasonal trends, though there has been no recent improvement in its departure from normal levels.

U.S. hogs/pigs report to show herd steady from year ago -survey – Reuters News (The USDA report is due at 2 p.m. CDT on Thursday).

Favorable late season conditions bode well for Canada wheat yield potential – Refinitiv Commodities Research; favorable harvest weather and late season conditions fractionally increase 2020/21 Canada wheat production to 35.1 [33.9–37.0] million tons, still below the USDA’s 36 million tons (as of 11 September); or current median estimate is below the StatCan’s 35.7 million tons reported in its August Production of Principal Field Crops (31 August), but above its latest estimate of 34.1 million tons according to Model-Based Principal Field Crop Estimates (14 September).

Canada rapeseed production remains steady as harvest pace picks up across the southern Prairies – Refinitiv Commodities Research; favorable harvest weather and late season conditions fractionally increase 2020/21 Canada rapeseed production to 20.1 [18.2–22.0] million tons, still above USDA’s 19.5 million tons (as of 11 September); o. Our current median estimate is above StatCan’s 19.4 million tons reported in its Production of Principal Field Crops (31 August) and Model-Based Principal Field Crop Estimates (14 September); we estimate planted area at 8.38 million hectares, down <1% from last season and fractionally below StatCan’s 8.41 million hectares.

Extreme wetness in the northeast lowers China corn production – Refinitiv Commodities Research; excessive wetness in the northeast lowers 2020/21 China corn production by <1% to 260 [253–268] million tons. In its September report, the Ministry of Agriculture lowered its China corn production estimate by 1.8 million tons to 265 million tons amid typhoon-induced damage.

The cost of China’s much-loved pork rib dishes is soaring after Beijing suspended imports of pigmeat from major supplier Germany, hurting restaurants still recovering from the coronavirus hit earlier this year; pork ribs are one of China’s best-selling menu items but many restaurants specializing in the cut rely on imports, which can be up to 10 times cheaper than local supplies.

The prices of live pigs in China declined 4.1 percent in mid-September compared to the previous 10 days, data from the National Bureau of Statistics (NBS) showed; since last year, China has implemented a string of policies to stimulate hog production and stabilize pork prices affected by African swine fever and other factors.

Argentina’s upcoming soy and corn crops will be smaller than last season’s due to dry weather and capital controls that are hurting farmers’ profits, the Buenos Aires Grains Exchange

Worsening drought across the northwestern Pampas slashes Argentina wheat yields – Refinitiv Commodities Research; continued dryness across the northwestern half of the Pampas lowers 2020/21 Argentina wheat production by 2% to 18.7 [16.1–21.3] million tons, despite relatively healthy soil moisture in the southeastern counterpart; in September’s WASDE (dated 11 September) USDA placed Argentina wheat production at 19.5 million tons, down from its previous estimate of 20.5 million tons; our current estimate puts planted area at 6.8 million hectares, down 1.9% from last season, slightly above 6.5 million hectares reported by Bolsa de Cereales in Buenos Aires and Bolsa de Comercio in Rosario.

Russia, one of the world’s largest grain exporters, has harvested 119 million tons of grain before drying and cleaning from 86% of the area with an average yield of 2.89 tons per hectare, data from the agriculture ministry’s analytical centre published on Wednesday showed.

Farmers have also sown winter grains for next year’s crop on 54.5% of the planned area, or on 10.5 million hectares, broadly in line with Sept. 22, 2019.

Russia looks set to cement its place as the dominant force in the wheat world; in 20 years, Russia has gone from being reliant on wheat imports to accounting for a fifth of global sales, as its fertile soils generate bigger harvests at attractive prices; more than 100 nations from Egypt to the Philippines buy its grain, and Russia has sought to extend that list by adding markets where its wheat has been excluded because of rules over grain quality.

Ukraine has exported 10.77 million tons of grain so far in the July 2020-June 2021 season, compared with 12.19 million tons at the same point of the previous season, the economy ministry said; the volume is down largely because of a decline in corn sales, which stood at 619,000 tons, versus about 1.93 million tons a year earlier; wheat sales stood at 7.45 million tons, compared with 7.53 million tons at the same point of last season.

Only 10% to 15% of Ukrainian area is suitable for sowing winter crops for the 2021 harvest due to severe drought which is increasing, the APK-Inform agriculture consultancy said; forecasters, who last week called the weather conditions the worst in 10 years, said they expected no rain in the next 4 days in Ukraine; Ukraine traditionally starts winter grain sowing in early September but this year farmers have not yet started due to drought.

Rains that could help the sowing of winter grains in Ukraine are expected this weekend, data from weather forecasters showed on Thursday; the rain is likely to cover most regions and last at least two days, the data show.

Euronext wheat edged down on Wednesday as a sharp fall in Chicago encouraged Paris prices to consolidate after a five-month high a day earlier; front-month December milling wheat settled down 0.75 euro, or 0.4%, at 194.00 euros ($226.71) a ton; the contract had risen on Tuesday to 195.75 euros, its highest since April 23, but faced chart resistance around that level.

German pig prices remain unchanged this week at 1.27 euros per kilogramme despite uncertainty about demand following a series of import bans after a case of African swine fever (ASF) was found; pig prices had been around 1.47 per kg slaughter weight before the ASF case was confirmed on Sept. 10 and had fallen to 1.27 euros a kg on Sept. 11.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.