Price Overview

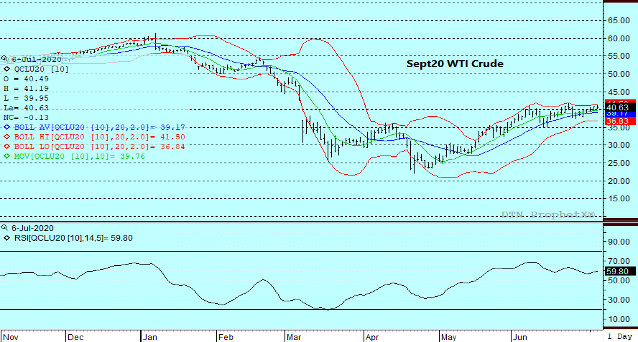

The petroleum complex traded on both sides of unchanged as optimism over demand in China was tempered by expectations of a slower recovery in the US and German markets. In the US, a resurgence of COVID-19 has tempered optimism over the recovery in gasoline demand and likely stalled a potential recovery in air travel. In Germany, sluggish manufacturing activity and fear that rising debt levels will lead to insolvencies has helped keep buying interest and volatility restrained.

Although the recovery in equity markets has underpinned the energy complex, supply and demand prospects present considerable uncertainty for values. Currently production cuts along with improved economic signals has likely been priced in. For now it appears that OPEC will be looking at maintaining production rates albeit at reduced levels past August. Although this might match up with prevailing demand trends, the decline in inventory levels will likely be slow. Any sign that demand is falling short of expectations will have a disproportionate impact on prices and put off any further recovery. How long OPEC members can tolerate the weaker growth in demand will be a key consideration. Growing public debt in many of these countries and its impact on political stability might become a key consideration for the acceptance of reduced production levels. With values now close to breakeven in the more efficient shale production areas, the competition for market share should become more intense, leaving it up to both Russia and Saudi Arabia to maintain production discipline within OPEC+ at their expense. How accepting they are of such a responsibility given the possible damage to their economies remains a potential vulnerability to the valuations of crude.

Ideas that OPEC+ and particularly Russia are content with values near current levels could create a headwind to values. Although it is encouraging that an improvement in global manufacturing activity is occurring, maintaining production restraint will be key to drawing down excess inventories. For now we are unconvinced that the pace of recovery from the pandemic and OPEC’s commitment to keeping production low is enough to avoid a further build in stocks, particularly if their production rises after July. This suggests that valuations much above 41.00 to 42.40, the panic gap from March 9th, are likely unsustainable.

Natural Gas

Prices surged to the upside today with the August reaching as much as 13 cents higher intraday before ending the session up by over 9 cents at 1.830. The recovery staged since the contract lows were put in last week has been primarily weather based, and the 65 bcf storage build reported on Thursday, which was well below expectations in the 78 bcf area, seemed to spur a second wave of buying that pushed us to current levels with the help of well above normal temperatures expected through much of July. Forecasts to start the week were for the most part revised downward, but still well above normal for the coming two weeks. The market appeared to draft much of its support from longer term forecasts suggesting that we may be in for a regime of above normal temperatures through August. The strength came despite an upward surge in production, as lower 48 output jumped to over 89 bcf/d over the holiday weekend, and continued poor LNG demand. In the face of these negative signals and continued concerns over COVID-19 resurgence, the market may have again gotten ahead of itself on todays move. Look for the 1.78 area to support any retrenchment, with our expectation for the recovery to continue with 1.87-1.90 offering the next resistance and a head and shoulders pattern on the charts that suggesting an eventual target at 2.05.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.