Price Overview

The petroleum complex remained under pressure as the settlement of the oil workers strike in Norway Friday and the passing of Hurricane Delta without major reported damage refocused attention back on the lifting of the force majeure in Libya, along with questions over the demand recovery following the rising infection cases in Europe and the US. The weak tone was exacerbated by prices falling back below the 100 day moving average at 40.50 basis December.

The Monthly Oil Report by OPEC comes out tomorrow, followed by the IEA Monthly Report on Wednesday providing revised forecasts for supply and demand. The supply side has been marked by the return of Libyan production into the world market, along with reports that Iranian export levels have increased despite US sanctions.

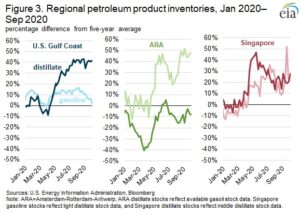

The EIA suggested in their October report that global product inventories remain high due to the significant decrease in transportation demand across all major petroleum hubs since the end of the 3rd quarter. Except for ARA gasoil stocks, petroleum product inventories in each location are higher than their respective five year average. The resulting weakness in refining margins has kept throughput of crude down, therefore limiting demand. Although OPEC has tried to adjust production in line with demand trends, it has not been enough to make a significant dent in inventories and leaves the market vulnerable to downside pressures if demand gets further constrained by an expansion in COVID cases during the winter months. In the Short Term Energy Outlook, the EIA suggested that the US GDP growth rate for 2020 and 2021 was revised upward. However they indicated that consumption of petroleum products for September was lower than forecast. Subsequently the EIA revised downward by 1 percent their forecast for 2020 and .5 percent in 2021. As a result of these revisions, the annual US consumption rate in 2020 fell to -11.3 percent while the 2021 growth rate increased to 9.6 percent.

Natural Gas

Natural gas kicked off the week with sharp gains as prices put in a gap higher open following Friday’s rally that was sparked by Hurricane Delta. The November contract settled up 14 cents on the day at 2.881. With GOM production likely shut in for another day or two, the market was spurred higher by indications that LNG processing facilities had dodged major damage. This was supported by early nominations today that came in at 7.1 bcf, a large jump from Friday’s 5.5 bcf. Backing up the price strength was a substantial upward revision in Heating Degree Day expectation in the two week forecast. Weather has not been helpful to the bulls as of late, and the increased demand potential could be the underlying factor that helps the improving LNG storyline finally establish a sustained uptrend in prices. Look for a pullback near term as production rebounds and attention turns away from the storm, with the gap likely filled on the November chart with a retrenchment under 2.80. As LNG facilities finally return to capacity in the coming days a test of the September highs near 3.00 is likely.

Charts Courtesy of DTN Prophet X, EIA, Reuters

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.