by market analysts Stephen Platt and Mike McElroy

Price Overview

Follow-through buying on the suspension of exports of more than 400 tb/d of supply from Iraq’s Kurdistan region along with a larger than expected decline in US crude inventories failed to be maintained as active profit taking developed over the 74.00 level basis May WTI. The weakness appeared to reflect a combination of influences which included the appearance that Soviet supplies are ample in the world market along with concern over renewed tensions between China and the US over Taiwan. Nevertheless, the pullback was generally modest overall given the gains since late last week and the appearance of stability in the US banking sector, recovery in Chinese demand and the larger than expected decline in US crude inventories. The latter should provide better support on setbacks toward the 70.30-70.50 level basis May.

We still see that with the scale of liquidation evident recently by hedge funds and speculative interests, the market is on a much more favorable footing for responding to fundamental influences that might impact the underlying supply demand balance. It still appears that Russian oil is still readily available and that it has crowded out some other crudes due to the level of discounting. Nevertheless, more favorable demand prospects along with stability in production levels due to recent price pullbacks will likely lead to a more balanced market in the second half that should limit declines much below the 70.00 level for prompt crude.

The DOE report showed crude inventories off 7.5 mb. Stocks at Cushing continue to decline falling by 1.6 mb. In products, gasoline stocks declined by 2.9 mb and distillate rose ,3 mb. Total stocks including products fell 10.7 mb. Net imports of crude oil remain low at .7 mb with net exports of crude and products strong at 3 mb/d. Disappearance levels for both crude and products continue to trail last years levels by 7.5 percent on a cumulative basis with the largest declines in middle distillate and propane.

Natural Gas

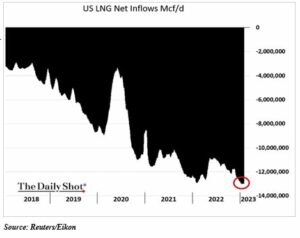

The expiration of the April Nat Gas attracted scattered buying interest as support near the 2.10-2.15 level held basis May. High storage levels continue to undercut valuations but with NGL flows increasing to record levels we look for better support to values to be apparent.. The recovery in Freeport shipments despite ongoing delays should help provide better support as exports exceed 13.0 bcf/d and usage expands on the price competitiveness to coal. Given the seasonal weakness to demand, any movement to the upside might be labored with initial resistance near 2.55-2.63 basis May. The EIA report is expected to show a storage draw of 52-58 bcf.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.