by market analysts Stephen Platt and Mike McElroy

Price Overview

Renewed liquidity concerns within the US banking system cut short a rally attempt that had carried values to the 70.00 area yesterday, with new lows reached today at 65.17. The early strength reflected the potential for a recovery in demand from China, possible Strategic Petroleum Reserve purchases, and ideas OPEC+ might act if the market looks to be moving toward imbalance. Concerns over the financial system undercut the rally attempt and led to large scale liquidation and stop loss selling as risk-off sentiment engulfed commodity and financial markets. The weakness, which has taken values down to levels not seen since December of 2021 reflects growing concerns of a recession, as tightness in credit markets potentially limits spending and derails recent signs of economic recovery. Fed policy is likely to be throttled back, the question of how much is certainly in the background following the bank bailouts to address concerns in the US and Europe.

Pressure on the Fed to raise rates has been ratcheted down as inflationary expectations weaken due to the banking problems. Next week’s meeting will be a key marker for the course of monetary policy, along with any additional problems that may emerge in the banking system.

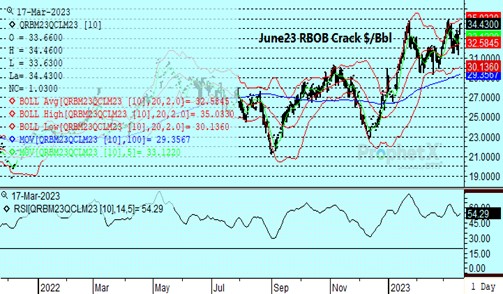

These economic concerns, along with recent expansion in refining capacity in Kuwait and at Exxon’s Baytown refinery, have had little impact on the crack margins, as the June RBOB crack has remained strong. A move through the 34.70 area could be a signal that the market is expecting a stronger economic trend into the summer months, contrary to current sentiment.

Natural Gas

After trading higher for much of the session yesterday, prices returned to the downside as the April contract lost 17.6 cents to settle at 2.338. A drop in demand expectations from overnight forecast revisions initiated the weakness, with help from yesterday’s storage draw of 58 bcf that was below expectations near 62, and well below the 5-year average decrease of 77. Total storage is now nearly 24 percent above the 5-year average as we near the shoulder season. Inconsistency from Freeport continues to give the market pause as well, as seen with initial nominations reported near 1.6 bcf yesterday, only to be revised down to .845 in the late cycle. The poor close and settlement below 2.40 does not portend well for the market near term, with little support in the way of a test down to the lows near 2.11. the 9-day moving average near 2.50 remains stiff resistance to a recovery in values.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.