by market analysts Stephen Platt and Mike McElroy

Price Overview

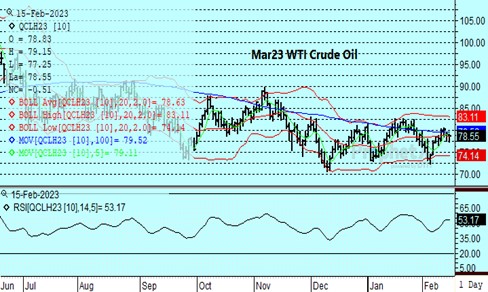

The petroleum complex showed a mixed tone, with crude settling 47 cents lower, gasoline higher by .93 and ULSD down 9.43 cents per gallon. Early weakness in crude reflected ideas that despite the sanctions and price cap, supply availability remains good. The opening of the Port of Ceyhan, reports of increases in Libyan supplies, and the approval of an additional 26 mb in SPR sales has helped dull fears of imminent tightness following the announced cut in Russian production of 500 tb/d. The stock situation in the US continues to improve, with the DOE reporting a build of over 16.3 mb despite the absence of SPR sales. Buying developed in crude in response to a recovery in equity values, ongoing signs of a stronger than expected US economy and increases in the pace of purchases of Russian crude by China.

The release of the monthly reports from OPEC and the IEA shed little light on the outlook. The IEA indicated that world oil supply looks set to exceed demand through the first half of 2023, but that the balance could quickly shift to deficit as demand recovers and some Russian output is shut in during the second half of 2023. They indicated that Russian oil production has held up relatively well as the country managed to reroute shipments to Asia, while the need to keep revenues flowing has kept them supplying barrels at heavily discounted rates due to the price cap. Nevertheless output in Russia is expected to decline as the year progresses.

The DOE report continued to show that supply availability in the US has improved. Commercial crude inventories rose by 16.3 mb to their highest level since June 2021 at 471.4 mb, compared to 411.5 mb last year. Cushing stocks rose .6 tb to 39.7. Refinery utilization was indicated at 86.5 percent, off by 1.4. Stocks of gasoline rose by 2.3 mb while distillates declined by 1.3. Total stocks of crude and products rose by 19.2 mb. Product disappearance continues to trail last year’s levels by 10.2 percent at 19.7 mb on a cumulative basis since the beginning of the year. Distillate, residual, propane and other oils showed the sharpest declines. The latter has likely accounted for the pressure on the 2-oil crack since early February.

Given the DOE report and weak disappearance levels, we would not be surprised to see the market decline toward the 74.50-75.00 area basis the prompt month. The better availability and uncertain demand environment will likely weigh on values near term. Support should emerge near those levels reflecting the likelihood that an economic decline will be mild and lead to supply/demand deficits later this year. How large those deficits are will be a determining force on how high prices recover with the 80-82 range remaining key resistance.

Natural Gas

The gradual return to operations at Freeport LNG continues to offer underlying support to the market, albeit tepid. Prices have traded in a tight range all week while testing above the 2.60 level every day. The lack of any weather risks remains the main limiting factor, with winter demand season quickly running out of chances. With a brief cold spell in store for the weekend, the market may find a way to test the 2.65 resistance area in the coming days, but with ample supplies and a quick moderation to forecasts the scope of the upside is limited. Tomorrows storage report is expected to show a withdrawl of 109 bcf, which is well below the 5-year average of 166. The failure to violate 2.65 keeps that area as solid resistance, with a settlement through there necessary to signal possible follow-through. Further weakness will find solid support near 2.35, with a failure there opening up the chance for a test of 2 dollars.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.