Soybeans and wheat traded higher. Corn and soymeal were unchanged. Soyoil was lower. US stocks were lower. US Dollar, Crude. Gold were higher. China economic data improving. US economy losing steam.

SOYBEANS

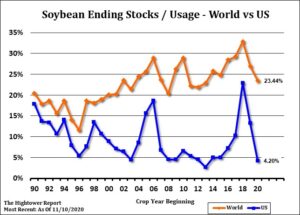

Soybean futures had a wild ride today. Overnight prices traded higher as new money were buyers. Some link that to tighter US balance sheet and concern about longterm South America weather. Market broke on concerns about higher Covid case and impact that might have on food and fuel demand and US economy. SF range was 11.76-11.96. Crop watchers lowered their estimate of Argentina soybean crop. Late Brazil soybean crop plantings could delay harvest and reduce crop size. US October soybean crush was record high. China hog expansion could increase their feed demand. US soybean balance sheet is getting tighter. Higher exports could lower carryout below 100. This could help push futures over 12.00. This could also trigger competition for higher US 2021 acres. USDA estimates World 2020/21 soybean and soymeal exports near 177.3 mmt versus 175.1 last year. US soybean exports 59.8 vs 45.6 ly. Brazil 85.0 vs 99.2 ly.

CORN

Corn futures traded mixed to marginally higher. New money came in overnight as buyers on talk of tighter US balance sheet, concerns about South America weather and talk of lower Black Sea supplies. Last selling pulled prices lower and some contribute to asset managers reducing longs as US/World Covid cases increase. Some crop watchers lowered their estimates of both Brazil and Argentina crops. USDA lowered Ukraine corn crop and exports. Trade is also watching to see if Russia and Ukraine imposes corn export taxes or quotas. US corn export prices are still the lowest to buyers. Managed funds were sellers of 1,000 corn. We estimate Managed Money net long 256,000 corn. For the week, corn is prices were up 7 cents. For the month corn prices are up 24. USDA announced 158 mt US corn sold to Mexico and 131 mt US corn sold to unknown. Some feel the sale to unknown may be to China. Current USDA corn 2020/21 supply and demand estimates US corn carryout near 1,702 mil bu with exports near 2,650. Some feel final exports could be closer to 2,900-3,000 which could drop the carryout below 1,400. This would still be bullish to prices. One analyst who is bullish soybean prices to 15.00 also feels a soybean/corn ratio of 3:1 would suggest 5.00 corn prices.

WHEAT

Wheat futures trade marginally higher. For the month SRW wheat prices are down 1 cent, up 9 1/4 in HRW and down 2 in HRS. Managed funds were buyers of1,000 wheat. We estimate Managed Money net long 20,000 contracts of SRW Wheat. Overnight, Managed funds were net buyers of grains. Also there was talk that new money may have entered the market last night due to concern about the long range US weather forecast. During todays session though, Asset Managers may have turned sellers of long equity, energy and grains positions as US and Global Covid cases are increasing and setting new records. Some US states are closing restaurants and limiting social gatherings for 4 weeks. This could slow food and fuel demand. This week’s NOAA 90 day US weather forecast suggested plains dry footprint expanding. This week, US HRW crop ratings improved but are still below average. Russia winter wheat crop is off to a poor start.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.