TODAY—WEEKLY EXPORT SALES—

Overnight trade has SRW Wheat down roughly 3 cents, HRW unchanged; HRS Wheat up 3, Corn is unchanged; Soybeans up 3; Soymeal up $1.50, and Soyoil up 30 points.

Chinese Ag futures (January) settled down 91 yuan in soybeans, down 10 in Corn, down 7 in Soymeal, up 30 in Soyoil, and up 32 in Palm Oil.

Malaysian palm oil prices were up 54 ringgit at 2,942 (basis January) using crude oil gains as support.

U.S. Weather Forecast: Last evening’s model run led to precipitation changes from Monday through Oct. 30. This put meaningful precipitation back into the southwestern Hard Red Winter Wheat Region and West Texas for Monday into Tuesday. The midday European model run was wetter in these two areas than this evening’s GFS model.

South America Weather Forecast: South America will still have improvement of weather over the next two weeks. A rain event is still expected to impact a majority of Argentina with meaningful moisture Saturday through Sunday. In Brazil, conditions will involve a mostly favorable mix of rain and sunshine. Some localized pockets in an area from Rio Grande do Sul through Parana will miss out from much rain in the first week of the outlook and will be in need of greater moisture in the second week.

The player sheet had funds net even in SRW Wheat; bought 17,000 Corn; bought 7,000 Soybeans; bought 6,000 Soymeal, and; net sold 1,000 Soyoil.

We estimate Managed Money net long 66,000 contracts of SRW Wheat; long 245,000 Corn; net long 254,000 Soybeans; net long 97,000 lots of Soymeal, and; long 80,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 4,100 contracts; HRW Wheat up 145; Corn up 29,900; Soybeans up 13,800 contracts; Soymeal up 3,000 lots, and; Soyoil down 2,700.

There were no changes in registrations—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 361; Soybeans 1; Soyoil 1,907 lots; Soymeal 250; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Algeria bought near 600,000t optional-origin wheat—Jordan passed on 120,000t optional-origin wheat—Thailand passed on 192,000t optional-origin feed wheat—S. Korean feed groups purchased unknown volume of optional-origin soymeal—

Wire story reports it is no surprise that Brazil is nearly out of soybeans given its extraordinary export pace earlier this year, but consistent with the bizarre nature of 2020, it is possible that Brazil could purchase beans from its export rival, the United States; that has never happened in modern times, especially since Brazil emerged last decade as the world’s top exporter of the oilseed; but neither U.S. nor Brazilian agencies seem to think Brazil will start importing U.S. soybeans, at least in the short term; Brazil’s government over the weekend announced the temporary suspension of the 8% import tariffs on corn and soybeans from outside the Mercosur trade bloc to help reduce food prices that are pushing up inflation.

U.S. ethanol production for the week ended October 16th averaged 913,000 barrels per day (down 2.56% versus a week ago, down 8.33% versus a year ago); stocks totaled 19.721 mil barrels (down 1.43% versus a week ago, down 7.69% versus last year); corn use for the week was 90.7 mil bu (93.1 mil last week) and versus the 97.7 mil bu needed to meet USDA projections.

—Data released by the EIA Wednesday showed that both US ethanol production and ethanol inventories are down from the previous week — which is being seen by some grains traders as a possible sign of states amping up their restrictions to limit a resurgent spread of coronavirus during this year’s flu season; President Trump promised that there would not be another national shutdown, but some high-driving states are threatening localized shutdowns that risk seeing lower ethanol demand at least partially offset the strong export demand that we are seeing this year,” says StoneX

A group of U.S. Republican senators asked the Environmental Protection Agency on Wednesday to consider a general waiver that would prevent an increase in biofuel blending obligations next year for oil refiners hit by a collapse in fuel demand because of the coronavirus pandemic.

China corn harvest up slightly from last season amid increased sown area – Refinitiv Commodities Research

As a grain trade conference ended on Wednesday in east China’s Fujian Province, purchase agreements for 36.17 billion yuan (about 5.44 billion U.S. dollars) worth of various grain products had been signed; the third China Grain Trade Conference drew delegations from 31 provinces, municipalities and regions, and over 2,600 enterprises to the city of Fuzhou, the provincial capital; the three-day event was held both online and offline; the online platform saw 10.3 million tons of various cereals and oils traded, with transactions totaling 29.24 billion yuan; the previous sessions of the China Grain Trade Conference were held in northeast China’s Harbin City and central China’s Zhengzhou City, which saw a total of 33 million tons of grain and oil traded, with turnover exceeding 70 billion yuan.

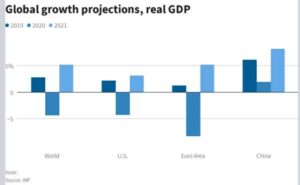

The United States and China dealt with the spread of the devastating coronavirus pandemic in vastly different ways, and that split is reshaping the global battle between the world’s two leading economies; about 11 months after the Wuhan outbreak, China’s official GDP numbers this week show not only that the economy is growing, up 4.9% for the third quarter from a year earlier, but also that the Chinese are confident enough the virus has been vanquished to go shopping, dine and spend with gusto; China’s total reported death toll is below 5,000 and new infections are negligible, the result of draconian lockdowns, millions of tests, and strict contact tracing that set the stage for an economic rebound.

Brazilian food processor BRF SA will stop production at a Halal chicken plant in the south of the country starting Nov. 16 for modernization work, the company said; the halt was reported in the local press and later confirmed by BRF, which said the work will be complete by Dec. 5; the objective of the measure is to adapt production to market demand.

Argentina wheat yield potential continues to dwindle despite recent/expected rainfall – Refinitiv Commodities Research

Russia has harvested 130.9 million tons of grain before drying and cleaning from 94% of the area with an average yield of 2.89 tons per hectare, data from the agriculture ministry’s analytical center published

Farmers have also sown winter grains for next year’s crop on 92% of the planned area, or on 17.7 million hectares, up 1.2 million hectares from Oct. 20, 2019, the center added.

Ukraine corn production lowered on analysis of late-season satellite imagery – Refinitiv Commodities Research

Analysis of late-season satellite imagery cuts 2020/21 Ukraine corn yield and production by 7% to 32.5 [28.0–41.9] million tons (mmt). National corn yield is now seen at 6.32 tons per hectare, with significant reductions in major producing oblasts, such as Poltava and Kirovorad (both down by ~1 ton per hectare). Ukraine harvested area is maintained at 5.1 million hectares, although reductions are possible as impacts of this season’s drought are better quantified.

Ukraine’s sunflower oil exports may fall to 5.6 million tons in the 2020/21 September-August season from around 6.6 million in 2019/20, the Ukrainian sunoil producers’ association said; Ukraine accounts for about 55% of global sunflower oil exports; Producers have said they expect that Ukraine is likely to harvest around 14 million tons of sunseed compared with 15.3 million tons in 2019.

Kazakhstan wheat production unchanged as harvests complete – Refinitiv Commodities Research

Euronext wheat ended flat on Wednesday, consolidating near contract highs as traders monitored dry weather in several exporting countries and awaited the outcome of an Algerian tender expected to yield fresh sales of European Union wheat; December milling wheat settled unchanged on the day at 211.25 euros ($250.82) a ton; on Tuesday it rose to 214 euros, a life-of-contract record and the highest spot price since August 2018, before closing slightly lower.

Mostly favorable early growth weather maintains EU 2021/22 rapeseed production – Refinitiv Commodities Research

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.