Soybeans, soymeal and corn jumped higher after USDA November crop and monthly Supply and Demand report. Wheat and soyoil followed. US stocks were higher. US Dollar was mixed. Talk of higher US debt could push US Dollar lower. Crude was higher. Gold was higher.

SOYBEANS

Soybeans traded higher. USDA lowered US 2020 soybean crop and US carryout lower than the average trade guess. Most feel the US carryout now suggest higher prices. Some could even see final US soybean exports higher than USDA guess and an even lower US carryout which could force prices higher to slow demand. Prices have rallied due to dry South America weather and could also trade higher if the weather stays dry. USDA estimated US 2020 soybean crop at 4,170 mil bu versus 4,251 expected and 4,268 in Oct. USDA estimated US 2020/21 soybean carryout at 190 mil bu versus 235 expected and 290 in Oct. USDA estimated US 2020/21 soybean exports at 2,200 mil bu versus 2,000 in Oct. Most feel final US soybean export could reach 2,350. USDA estimated World 2020/21 soybean carryout at 86.5 mmt versus 87.4 expected and 88.7 in Oct. World stocks to use ratio is down to 23 pct. USDA left China soybean imports at 100 mmt. Brazil exports remain near 85 mmt. USDA lowered Argentina soymeal exports to 27.5 from 29.0. Most still are looking for SF or SH21 to test 12.50.

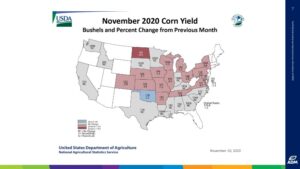

CORN

Corn futures traded higher after USDA dropped US 2020 corn crop below the average trade guess. USDA also raised US corn exports, lowered Ukraine supplies and dropped US 2020/21 corn carryout below the average trade guess. Some feel CZ could test 4.50 due to the dry weather in the Black Sea and Argentina. Corn prices will need to remain firm to make sure US farmers add acres in 2021. USDA estimated US 2020 corn crop at 14,507 mil bu versus 14,659 expected and 14,722 in Oct. USDA estimated US 2020/21 corn carryout at 1,702 mil bu versus 2,033 expected and 2,167 in Oct. USDA estimated US 2020/21 corn exports at 2,650mil bu versus 2,325 in Oct. USDA estimated US 2020/21 feed use near 5,700 versus 5,827 last year and ethanol 5,050 versus 4,852 last year. Some feel a vaccine in 2021 could help rebound US travel and gas use and ethanol use. USDA estimated World 2020/21 corn carryout at 291.4 mmt versus 296.3 expected and 300.4 in Oct. USDA increased China corn imports to 13 mmt versus 7 previous. Most are near 22. USDA still estimates Brazil corn crop near 110 mmt. USDA dropped the Ukraine crop to 28.5 mmt from 36.5. They lowered Ukraine corn exports to 22.5 from 30.5. EU corn imports were dropped to 20 mmt from 24.

WHEAT

Wheat futures traded higher. USDA did not change a lot of US and World wheat numbers in their November update. Still prices followed the higher corn price. USDA estimated US 2020/21 wheat carryout at 877 mil bu versus 881 expected and 883 in Oct. USDA est US 2020/21 HRW carryout near 338 versus 506 ly, SRW carryout near 107 versus 105 ly and spring 284 versus 280 last year. USDA est US 2020/21 HRW exports near 405 versus 375 ly, SRW exports near 75 versus 92 ly and spring 270 versus 268 last year. USDA estimated World 2020/21 wheat carryout at 319.7 mmt versus 320.4 expected and 321.4 in Oct. USDA estimate the Russia crop at 83.5 mmt, Ukraine at 25.5, Argentina 18.0 and EU exports at 26.0. All of these numbers could be too high. Dry weather patterns continue in the Black Sea, US south plains and Midwest and east Argentina and South Brazil. These weather patterns also support prices. WZ is near 6.08. Support is near 5.80. Initial resistance is near 6.20 the 6.40. KWX is near 5.55. Support is near 5.40. Resistance is near 5.80. French Matif futures are making new highs on reduced exports. Russia domestic Flour and wheat prices are at all-time highs. Trade is watching to see if Russia imposes wheat export quotas.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.