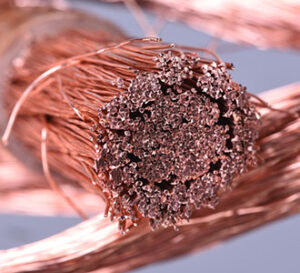

COPPER

With a loss of upside momentum and the appearance of significant resistance at $2.9845 in the December copper contract, it would appear as if the bear camp holds the edge today. As in many other physical commodities, the copper market is undermined as-a-result of the failure to lead in Washington which in turn has offset favorable international economic data this week. However, the market is seeing some support from official word of strike action in Chile and from a 4th straight month of gains in German factory activity.

GOLD / SILVER

Clearly, the gold and silver trades are tracking the ebb and flow of physical demand and the abrupt breakdown of the stimulus package talks shifted the bias downward yesterday and that bias remains down to start today. Unfortunately, for the bull camps in gold and silver, the US scheduled report slate today contains almost no reports of importance and therefore the ability to shore up physical demand hopes from positive news from the economy is not likely.

PALLADIUM / PLATINUM

In retrospect, the palladium market performed impressively for the bull camp yesterday as it managed to stay firm in the face of negative macroeconomic/political developments and in the face of pressure in all other precious metals markets. In fact, the palladium market has extended its favorable chart set up with a higher high in the early going today. As indicated already, the platinum market appeared to suffer from the unwinding of long platinum short palladium spreads but some funds might have turned outright bearish toward platinum given that trading volume has disintegrated (since the early September high) and there has been a decline in open interest.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.