Soybeans, soymeal, and corn traded higher. Soyoil and wheat traded lower. US stocks were higher. US Dollar was lower. Gold was higher. US Fed inflation talk could help Stocks and commodities and hurt US Dollar.

SOYBEANS

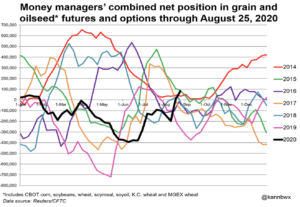

Soybean traded higher with Nov trading over 9.50. Next upside target could be 9.75. Futures have erased most of the US and China trade war losses due to dryness across the west Midwest. Most look next weeks US soybean crop ratings to drop another 3-4 percent. Good China buying US new crop soybean has also helped futures rally. US farmer has been an active seller of soybean on this rally. They are using soybean sales and US aid checks to pay bills and are still planning to store this years corn crop. Key to next weeks price action will be fund action and perception of US crop size. Futures are becoming overbought. China new crop sales are near 12.5 mmt, unknown is 6.7 mmt and 1.5 mmt has been sold since the report. Assuming 158 mil bu unshipped old crop sales are rolled forward, US new crop export commit is near 950 mil bu or 45 pct of USDA goal. Non China World soybean buyers are slow buyers. Brazil prices are cheaper than US Feb forward.

CORN

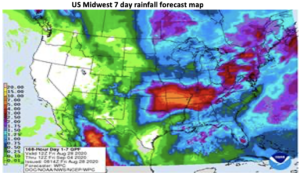

Corn futures traded higher. Sep corn gains on Dec going into first notice day. Strong cash basis levels could limit deliveries. Managed funds continue to liquidate net short positions. Dec corn is up against key technical resistance. Dry weekend across parts of the west US cornbelt could push Dec corn over resistance. US farmer continues to be a reluctant seller of corn. Most look for next weeks corn crop rating to drop 2-3 pct. Managed funds were late buyers of 3,000 corn. Managed funds are net short 53,000 corn Fact US western states rain forecast is less than normal has helped futures. What if it does not rain over the weekend in Iowa? What if it does? US corn futures are higher on concern about US corn crop size. China new crop corn sales are near 6.4 mmt with 1.6 mmt sold since the report. Assuming that 75 mil bu of old crop unshipped sales are rolled forward total new crop commit is near 24 pct of USDA goal. 3.60-3.65. CZ could be strong resistance as US harvest near. Brazil announced they will temporarily drop the imports tax for AG products. Could this mean they might buy US corn and/or ethanol?

WHEAT

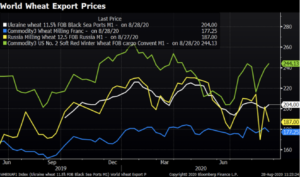

Wheat futures traded lower. Lack of follow through buying near Key resistance may have offered resistance. Dry US August in not affecting wheat crops yet. Talk of higher Russia and Australia supplies offset talk of lower EU crops and dryness in Argentina. Matif and Black Seas prices rallied on talk of slow farmer selling. Fact Russia may soon send subsidy checks to farmers has reduced their need to sell the crop. Domestic prices are higher than export. There is talk of increase export interest for Russia wheat. Managed funds have been sellers of 4,000 wheat. Managed funds are net long 13,000 wheat. For the week, SRW Wheat prices are up roughly 13 cents and HRW up 13. USDA continues to estimate US 2020 wheat supply near 3,011 mil bu versus 3,105 last year, total demand near 2,086 versus 2,062 and end stocks near 925 versus 1,044 last year. USDA also estimates World 2020/21 wheat crop near 766 mmt versus 764 last year and end stocks near 317 versus 301 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.