Soybeans, corn and wheat traded higher. US stocks traded higher. US Dollar traded lower.

SOYBEANS

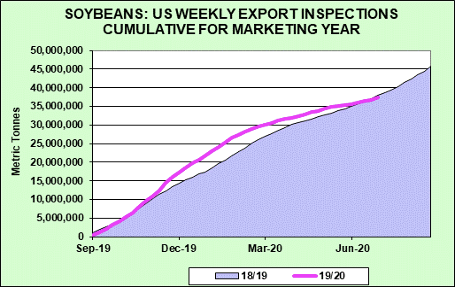

Soybean market traded higher. Talk of drier US Midwest weather later in July offered support. Trade is still trading the fact USDA June acreage report was bullish. Concern about demand and uncertainty over the accuracy of the long range weather maps limited the upside. US Farmer selling has increase as nearby soybean futures neared 9.00. Weekly US soybean exports were near 521 mt versus 333 last week and 761 last year. Season to date exports are near 37.3 mmt versus 37.8 last year. USDA goal is 44.9 mmt versus 47.5 last year. On July 10 most are looking for a US 2019/20 US soybean carryout near 600 mil bu versus USDA 585. USDA should drop exports demand. USDA should keep US the 2020 US soybean crop near 4,125 mil bu. This suggest US 2020/21soybean carryout could remain near USDA 395 mil bu. USDA could leave World 2020/21 soybean end stocks near 96 mmt. USDA is expected to increase weekly US soybean crop ratings.

CORN

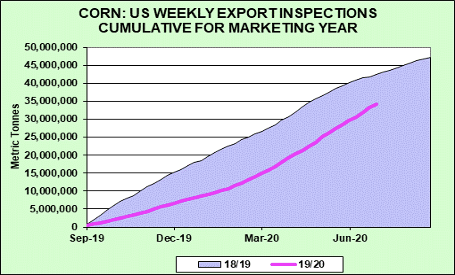

Corn futures traded higher. Uncertain US Midwest 2 week weather outlook gave mixed inputs to futures. Funds have covered a portion of their record et corn futures and option short but may need to see more damaging US Midwest weather to cover more. Slow US Export demand and concern increase in US virus cases could slow US domestic food and fuel demand limited the upside in prices. US farmer has also been and active seller of cash on the recent rally. Over the next week 60 pct of the US Midwest should see normal rains with temps above normal. 40 pct of the Midwest will see less than normal rains. On July 10 USDA will issue ne US supply and demand tables. For corn, most are looking for a US 20919/20 US corn carryout near 2,300 mil bu versus USDA 2,103. USDA should drop feed/residual demand. USDA should lower US 2020 corn acres which could drop the 2020 US corn crop from 15,995 to 15,000. This suggest US 2020/21corn carryout could be closer to 2,700 versus USDA 3,323. USDA could drop World 2020/21 corn end stocks 14 mmt to 324 mmt due to a lower US crop. Still the stocks are adequate for demand. Weekly US corn exports were near 962 mt versus 1,241 last week and 721 last year. Season to date exports are near 34.2 mmt versus 42.7 last year. USDA goal is 45.5 mmt versus 52.9 last year.

WHEAT

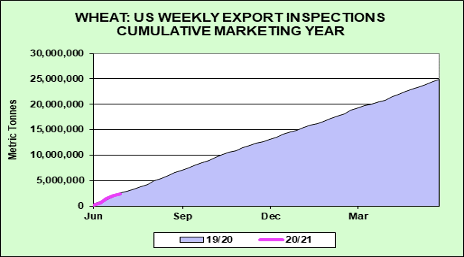

Wheat futures managed small gains. Wheat tended to follow higher corn prices and the lower US Dollar. Increase Russia harvest is pressuring domestic Russia wheat prices which also offers resistance. Weekly US wheat exports were near 326 mt versus 515 last week and 628 last year. Season to date exports are near 2.3 mmt versus 2.6 last year. USDA goal is 25.8 mmt versus 26.3 last year. Also on July 10 most are looking for USDA to estimate US the 2020 US all wheat crop near 1,850 mil bu versus USDA 1,877. HRW crop could be near 710 versus 743, SRW crop near 290 versus 297 and HRS crop near 560. This suggest US 2020/21wheat carryout could remain near USDA 940 mil bu. Most feel USDA could keep World 2020/21 wheat end stocks near the record 316 mmt. Some could see a drop in Europe and Black Sea supplies.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.