Soybeans, soymeal, soyoil, corn and wheat traded lower. US stocks were sharply lower. Crude was lower. US Dollar was higher.

SOYBEANS

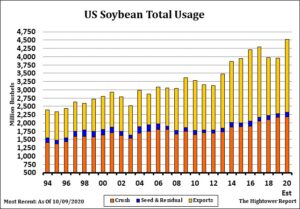

The soybean market continues to see liquidation ahead of first notice day for November soybean futures on Friday. Equity and commodity traders are also reducing positions ahead of the US elections next week. Hopes for a financial aid bill ahead of the election have expired. Improving weather in South American soybean areas has been negative. US Midwest drier weather forecast should allow soybean harvest to be completed in most areas in FH November. The trade awaits new Chinese buying of US soybeans. Trade estimates for US 2019-20 and 2020-21 US soybean carryout are below USDA’s estimates. USDA will issue their 10 year baseline supply/demand estimates for the grains next week, which will include USDA’s first estimates for the 2021-22 US soybeans. Weekly US soybean export sales are estimated near 1,000-2,000 mt versus 2,225 last week. USDA announced 110 mt US soybeans to Egypt and 120 mt US soybeans to unknown. USDA estimates US soybean exports near 59.8 mmt versus 45.6 last year. World soybean export are estimated near 167.8 mmt versus 164.4 last year.

CORN

Corn futures traded lower on higher US dollar, increase cases of COVID in US and Europe, lower crude oil and European and US equity markets. Most of the selling was linked to position evening ahead of the US elections. Weather forecasters continue to expect widespread rains across Brazil corn central and southeastern Parana/Santa Catarina and southwest Sao Paulo. The next chance for rain in Argentina is in the 6-10 day period. The trade awaits new Chinese buying of US corn. USDA will issue their 10 year baseline supply and demand estimates for the grains next week, which will include USDA’s first estimates for 2021-22 US corn. USDA estimate of China’s 2020-21 corn imports at 7.0 mmt seems low, USDA will likely show a 2020-21 US corn carryout over 2300 mil bu. Many could view weakness into next week as a buying opportunity, looking for additional Chinese buying of US corn which could result in higher US exports and lower carryout. Weekly US corn export sales are estimated near 700-1,500 mt versus 1,831 last week. USDA announced 207 mt US corn to S Korea. USDA estimates US corn exports near 59.0 mmt versus 45.1 last year. World corn export are estimated near 184.4 mmt versus 170.5 last year. Weekly US ethanol production was up from last week but down from last year. Stocks were both down from last week and below last year.

WHEAT

For most of 2020, December Chicago wheat futures traded in a 5.00-5.80 range. Prices jumped over 6.00 on concern over dry weather in Argentina, Russia and US south plains. Open interest jumped 100,000 contract and Managed funds added 36,000 contract to their net long. This week, rains in parts of US south plains, Black Sea and South America triggered long liquidation. Increase global/US Covid cases raised concern about future demand for food. Managed money also trimmed positions before US election and potential for a Blue wave win. Wheat futures are expected to remain volatile in 2021. This week, one large US Bank suggested in 2021 there could be a rally in commodities on inflation concerns and draw down in commodity supplies. Trade is awaiting word on China 5 year plan that could include spending for infrastructure and adding to strategic reserves including energy and raw commodity needs. All of this could increase their import needs. Weekly US wheat export sales are estimated near 200-700 mt versus 367 last week. USDA estimates US wheat exports near 26.5 mmt versus 26.2 last year. World wheat exports are estimated near 189.9 mmt versus 190.5 last year.

Click here for complete view

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.