Soybeans and soyoil traded higher. Corn, soymeal and wheat traded lower. US stocks were marginally higher. US Dollar and Crude were mixed. Gold was lower. Meats were sharply lower.

SOYBEANS

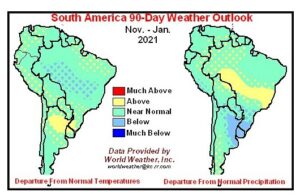

Soybean traded higher. Higher World vegoil prices continues to support soyoil which offered support to soybeans. Managed funds were net sellers overnight on better central and north Brazil rains than expected. Brazil and Argentina 7 days forecast calls for rains in the dry areas of south Brazil and north Argentina. Weekly US soybean export sales were above expectations at 1.387 mmt with sales to China at 1.060 mmt, bringing their commit to a record large 28.6 mmt. US soybean export sales commit total a record large 1884.5 mil bu vs 867 mil bu last year. China’s commit at 28.6 mmt, plus a possible 5.5-6.0 mmt of the 10.1 mmt in unknown that could be to China would result in a total commit of about 34.0-34.5 mmt. Some feel China could take 38 mmt from US. Higher China demand and any South America weather problems could push SF over 12.00 World vegoil numbers could suggest soyoil futures could trade over 40.

CORN

Corn futures traded lower. Concern about increase virus cases weighed on most equity, energy and commodity markets. Meat trade traded sharply lower. Better than expected Brazil rains also offered resistance. forecast of rains next week over parts of the dry areas of south Brazil and north Argentina may have also triggered some long liquidation near new highs. Managed funds were net sellers of 4,000 corn. We estimate Managed Money net long 257,000 corn contracts. US corn export sales were 1.088 mmt and above expectations, bringing commit to a record large 1388 mil bu versus 522.1 mil bu last year. Some feel USDA export guess of 2,650 might be low. Some estimates are closer to 3,000. China’s commit is near a record large 10.94 mmt. With sales of 5.3 mmt to unknown, China commit likely totals 12.0-13.0 mmt versus USDA projection for China’s total corn imports at 13.0 mmt. Some feel total China corn imports could exceed 25.0 mmt. Weekly US sorghum export sales were 117.9 mt, with China adding 131 mt to their commit, which now totals 3.05 mmt out of total US commit of 3.93 mmt. Both Russia and Ukraine domestic feeders are asking their governments for corn export quotas to preserve domestic supplies. This could help increase final US exports and lower the 2020/21 carryout.

WHEAT

Wheat futures trade lower led by KC. Weather forecast calls for rains across the US south plains. GFS model has good rains and coverage. EU model has less rains but a little more than yesterday. Rains may not help wheat stands buy will add moisture for the spring. Over the last few days some of the dry areas of Russia also saw good rains. Key will be if the rains continue across the Black Sea. Russia domestic wheat buyers are asking the government for new wheat export quotas to help the domestic preserve supplies. Weekly US wheat export sales were near 192 mt. This was below expectations and last week. Total commit is near 17.2 mmt versus 15.6 last year. USDA US wheat export goal is 26.5 mmt versus 26.2 last year. Wheat futures may be in a range depending upon 2021 World weather. Managed funds were net sellers of 4,000 wheat. We estimate Managed Money net long 19,000 contracts of SRW wheat. WZ support is near session low and 5.89. Resistance is 6.04.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.