SOYBEANS

The soybean complex was mostly lower with soybeans down $.05 – $.14, soybean meal down $3 – $6, while soybean oil was mixed with nearby contracts up 10 – 15 with back months down a similar amount. May-23 soybeans held another challenge of their late Feb-23 low just above $14.75. According the recent CFTC report Money managers were net seller of nearly 80,000 contracts in the soy complex in the week ended Tues. Feb. 28th. Their combined position in the soy complex slipped to just under 298,000 contracts, the smallest in 3 months. NOPA crush in Feb-23 at 165.4 mil. bu. was slightly below the average trade estimate of 166 mil. Soybean oil stocks slipped to 1.809 bil. lbs, down from 1.829 bil. in Jan-23 and below expectations of 1.886 bil. With NOPA members representing roughly 95% of the US crush capacity I expect total US crush in Feb-23 at 175 mil. bu., matching a record high for the month. YTD crush in the first 6 months of the Sept thru Aug MY would reach 1.107 bil. bu., down 1% from YA, vs. the revised USDA forecast of up 1%. In order to reach the lowered USDA forecast, crush Mch-23 thru Aug-23 would have to reach a record 1.113 bil., vs. 1.085 bil. YA. This is doable given that crush margins remain historically strong, however well off the recent highs. Pretty good close today in spot May-23 soybeans, down only $.04 ½ , with so much bearish macro news. Export sales tomorrow expected at 10 – 30 mil. bu. soybeans, 0 – 10k tons soybean oil, and 100 – 350k tons soybean meal.

CORN

Corn prices were up $.03 – $.06 in old crop, while new crop was down $.02 – $.03. Shares of European bank Credit Suisse plunged 30% at their lows following news their largest shareholder wouldn’t increase its investment in the bank as it would trigger regulatory rules. Saudi National Bank is the largest shareholder with a 9.9% stake. Still no confirmation of the Black Sea Grain Initiative being extended. While the corridor has remained open during negotiations Russia is insistent on a 60 day extension, while Ukraine seeks another 120 days. The Feb-23 PPI fell .1% vs. expectations for a .3% increase. In addition the Jan-23 PPI was revised to a .3% increase, down from .7% previous. YOY prices rose 4.6% in Feb., down from 5.7% in January. The USDA announced the sale of 667k tons (26 mil. bu.) of old crop corn to China. This makes 50 mil. bu. total the last 2 days. Ethanol production last week increased to 1,014 tbd, up from 1,010 tbd the previous week. There was 102 mil. bu. of corn used in the production process, slightly below the pace needed to reach the USDA corn usage forecast. Ethanol inventories surged to 26.4 thousand barrels, the highest level in nearly 1 year. Gasoline demand last week was down 4% from YA, with the 4 week average unchanged. The updated CFTC report showed MM’s sold just over 147,000 contracts of corn in the week ended Tues. Feb. 28th, reducing their long position to 68,635 contracts, their smallest long position since Sept-20. Export sales tomorrow expected to range from 30 – 60 mil. bu.

WHEAT

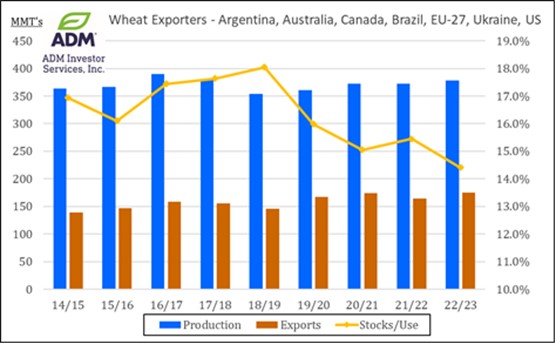

Wheat was higher across the board with limited fresh news, just awaiting terms of the possible extension of the BSGI. All classes closed $.03 – $.06 higher. UkrAgrocolt’s raised their Ukraine winter wheat acreage forecast to 4.1 mil. hectares, above the Ag Ministry’s est. of 4.0 mil. HA. Germany’s wheat production is forecast to slip 2.3% this year to 22 mmt. Jordan’s state grain buyer has set Mch 21st as deadline for their 120k mt tender for mill grade wheat. With global stock/use among major exporter at a decade low just over 14%, many countries expecting lower production this year, a huge short (at least in CGO) by large speculative traders, and uncertainty still surrounding the BSGI, the risks seems tilted to higher prices. Exports expected 6 – 16 mil. bu.

See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.