Soybeans, soymeal, corn and wheat traded higher. Soyoil traded lower. US stocks were lower. US Dollar was higher. Crude was lower. Gold was higher.

SOYBEANS

Soybeans started the day lower on talk of good C Brazil rains, concern over increase political tension between US and China slowing their buying of US Ag goods and weak financial markets due to talk of the potential of no EU traded deal. Record 2 week US soybean exports offered support. Talk of new China buying new crop Brazil soybeans and new crop US soybean also offered support especially SX21. Weekly US soybean exports were near 84 mil bu versus 89 last week and 51 last year. Season to date exports are near 1,081 mil bu vs 638 last year. USDA goal is 2,200 vs 1,676 last year. Some are as high as 2,350. One group est last week US 2020/21 soybean carryout near 65. Dec 1 stocks 2,822 vs 3,252 ly. Dec-Feb use a record 1,439 vs 1,002 ly. Exports 905 vs 505 ly. Mar-May use 744 vs 873 ly. Exports 240 vs 247 ly. US China soybean exports are est at 1,396 vs 583 ly. China took 56.5 mil bu of US soybeans or 63% of the weekly export total. Some feel that China loadings from the US will stay active well into Feb.

CORN

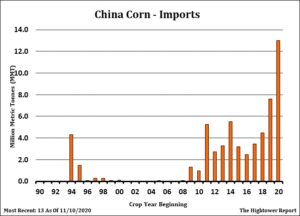

Corn futures traded higher. Early trade was lower on C Brazil rains, lack of new US corn sales to China and concern over increase US and World Covid cases could force additional shutdowns and a continued slowdown in food and fuel demand. Better than expected weekly US soybean exports offered support to prices near session lows. Managed funds are buyers of 12,000 corn. We estimate Managed Money net long 283,000 Corn. Weekly US corn exports were near 29 mil bu versus 19 last year. Season to date exports are near 434 mil bu vs 257 last year. USDA goal is 2,650 vs 1,778 last year. Some are as high as 3,000. One group est US 2020/21 corn carryout near 1,542. Dec 1 stocks 12,045 vs 11,327 ly. Dec-Feb use a record 8,266 versus 7,951 ly. Exports 465 vs 270 ly. Mar-May use 3,687 vs 2,942 last year. Exports 672 vs 355 ly. US China corn exports 815 vs 80 ly. Last week, Informa est World corn crop near 1,137 mmt versus 1,117 last year. Informa dropped EU crop 2 mmt to 60 vs 66 last year. Informa est World 2021 corn crop near 1,179 mmt. Talk of drier than normal S Brazil and Argentina weather should help push corn futures higher.

WHEAT

Wheat futures traded higher. At times wheat trades lower on talk that higher supplies in Russia, India, Canada and Australia has taken most of the weather premium out of prices. Still, there is concern about 2021 Russia, US and Argentina supplies. This and lower US Dollar and higher US corn prices could support prices. Break in prices does give end users an opportunity to add to 2021 coverage. Weekly US wheat exports were near 19 mil bu versus 13 last year. Season to date exports are near 495 mil bu vs 479 last year. USDA goal is 975 vs 965 last year. Informa estimated World wheat crop near 775 mmt versus 764 last year. Informa dropped Canada crop 1 mmt but raised Australia 2 mmt. Informa est World 2021 crop near 789 mmt. Same group est US Dec 1 wheat stocks near 1,720 mil bu vs 1,841 ly. To push over resistance, grain futures need less than ideal 2021 US, Black Sea and South America weather, increase China buying US Ag goods and a successful vaccine that will increase food demand.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.