Soybeans, soymeal, soyoil, corn and wheat traded higher. Drier than normal weather pattern across parts of Brazil and Argentina is beginning to lower their estimates of 2021 crops. Lack of new US/SA farmer selling until the new year is also supportive today. US stocks are higher. US Dollar is lower. Crude is higher.

SOYBEANS

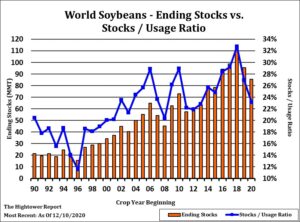

March soybean tested 11.89 on new concerns about 2021 South America soybean supplies. Some talk that near record low World soybean to stocks ratio calls for higher soybean prices is also supportive. US farmers have sold as much as 80-85 pct of the 2020 crop which limits new selling above the market. One crop analyst estimates the Brazil soybean crop at 130 mmt with a range of 123-132. They estimate Argentina soybean crop near 48 mmt with a range of 44-48. USDA estimates Brazil soybean crop near 133 and Argentina 50. Another group sees the Argentina soybean crop near 128 mmt. These groups estimate that it is just a matter of time before higher prices reflect lower South America supply, higher US exports than USDA guess and lower carryout. Some feel and objective of March soybeans could be 13.00-14.00. Record US soybean export and crush to date also supports prices.

CORN

Corn futures managed only minor gains today. Rally in soybean and soymeal futures left corn in the dust. Some feel Managed funds are already long a good percent of the corn they want to be long. They see all of the talk about dry South America weather and increase in US exports and a lower carryout supporting prices but they want to see the proof. US/SA farmer may be done selling cash for the rest of 2020. This is supportive the basis and futures near key resistance. Some estimate that increase US farmer over the last few weeks now have them 70 pct sold of the 2020 crop. One crop analyst estimates the Brazil corn crop at 102 mmt with a range of 97-104. They estimate Argentina corn crop near 47 mmt with a range of 45-49. USDA estimates Brazil corn crop near 110 and Argentina 49. Another group sees the Argentina corn crop between 40-43 mmt. They also forecast Argentina corn exports near 27-29 mmt versus USDA 34. Some feel and objective of March Corn could be 4.50-4.60.

WHEAT

Wheat futures managed to traded higher. On again off again trade in Wheat futures was on again today. The big unknown is World 2021 crop supply. Some feel dry weather in US plains and parts of the Black Sea and cold temps in Russia winter wheat areas could drop final crops sizes there. Some even fear that Russia 2021 crop could be near 72 mmt versus USDA guess of 84. USDA dropped World wheat stocks in their December guess due to increase wheat feeding. Some feel US cannot make up for a drop is Russia supplies. It remains a difficult task to guess the daily direction of wheat futures. Russia will impose an Export tax on 17.5 mmt of wheat exports starting Feb 15. Sill some feel buyers will trying to buy Russia wheat before the tax starts. Some feel talk of a lower 2021 crop could speed up the date the tax starts and could even reduce wheat export quota.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.