What a day. Soybeans, soymeal, soyoil, corn and wheat traded sharply higher after friendly USDA Sep 1 stocks report. The USDA number do not add up but the machines bought futures anyway. US stocks were also higher on talk that US Treasury Secretary and House speaker may be closer to a new stimulus package.

SOYBEANS

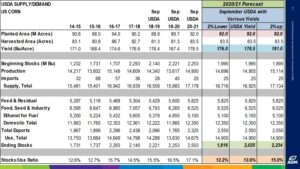

Soybeans traded sharply higher after USDA estimated US Sep 1 stocks below the average trade guess. Managed funds are net buyers of 27,000 soybeans, 15,000 soymeal and 5,000 soyoil. Managed funds are net long 214,000 soybeans, 72,000 soymeal and 100,000 soyoil. USDA revised the US 2019 soybean crop. US 2019 soybean crop is now 3,552 mil bu with versus USDA previous 3,552. USDA estimated US soybean Sep 1 stocks at 523 mil bu versus USDA 575. The number was below the trade guess. The number also implies Q4 residual at -15 versus -63 expected and -96 last year. USDA did announce 215 mt US soybean was sold to unknown. Dry weather in Brazil is offering support to soybean futures. There is a chance for Brazil rains after Oct 9. There has been only 1 year that dry weather in Brazil extended past Oct 24. It was a La Nina year. Guesses for weekly US soybean export sales is near 1,500-2,500 versus 3,195 last week. SX range today was 9.87 to 10.34. Support is now 10.08. Resistance is 10.50.

CORN

Corn futures traded sharply higher after a friendly USDA Sep 1 stocks report. USDA numbers do not add up and most analyst do not trust the numbers. Still, the funds bought the reversal in trade. Managed funds were net buyers of 20,000 corn. Managed funds are net long 110,000 corn. USDA revised the US 2019 corn crop. US 2019 corn crop is now 13,619 mil bu versus USDA 13,617. USDA estimated US Sep 1 corn stocks at 1,995 mil bu versus USDA 2,253. Where did all the corn go? USDA did not lower the crop. Q4 feed demand was not that high. The implied Q4 feed and residual number is now 1,923 mil bu versus 1,665 expected and 1,726 last year. Still, US farmer is not yet a seller. Dry weather in Brazil, Argentina and Russia is also supporting prices. US Midwest 2 week weather forecast calls for below normal rains. First week is cooler than normal. Second week could see temps closer to or even above normal. Guesses for weekly US corn export sales is near 800-1,400 mt versus 2,139 lasgt week. Weekly US ethanol production was down 2 pct from last week and down 8 pct from last year. Stocks were down 1 pct from last week and down 15 pct from last year. CZ range today was 3.62 to 3.82. Support is now 3.59. Resistance is 3.86.

WHEAT

Wheat futures trade sharply higher after USDA estimated US Sep 1 corn, soybean and wheat stocks lower than expected. WZ was up 28 cents. WZ range was 5.47-5.87. Most were looking for WZ to remain in a 5.30-5.70 range. Dry weather in Russia and US south plains offers support. Large global wheat supplies and slowdown in World trade due to Covid was offering resistance. KWZ closed up 33 cent. KWZ range was 4.75-5.15. Most were looking for KWZ range was 4.60-4.90. USDA estimated US wheat Sep 1 stocks at 2,159 mil bu versus 2,346 last year. This implies Q1 residual use near 249 mil bu versus 205 expected and 166 last year. USDA estimates total annual residual near 90. USDA also estimated US 2020 wheat crop near 1,826 mil bu versus 1,838 previous. They dropped the HRW crop 39 mil bu and SRW crop 11 mil bu and raised HRS 9. White winter was up 20 mil bu. Guesses for weekly US wheat export sales are 200-500 mt versus 351 last week.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.