Soybeans, soymeal, soyoil, corn and wheat traded higher. China buying and global weather concerns pushed prices higher. US stocks were lower. US economy needs more stimulus. US dollar is lower. Crude is lower. Gold is higher.

SOYBEANS

Soybeans surged to new highs on active professional buying. New buying linked to positive tech signal. Positive tech action linked to increase China buying US soybeans and concern that US supplies may be getting smaller. Managed funds were buyers of 6,000 soybeans, 5,000 soymeal and 4,000 soyoil. Managed funds are net long 234,000 soybeans, 57,000 soymeal and 100,000 soyoil. Fact Asian soymeal and vegoil markets were sharply higher overnight supported US futures. USDA announced 132 mt US soybean sold to China. Weekly USDA sales report showed China soybean commit near11.3 mmt and unknown 9.3 mmt. There is talk that they have also bought an additional 1 mmt of US soybeans since this report. There is also talk that China has sold back Oct-Nov higher Brazil prices soybean cargoes and bought lower US priced ones. Food and Ag Commodities Economics (Informa) estimated US 2021 soybeans acres near 87.1.

CORN

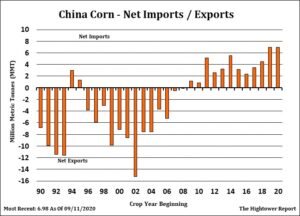

Corn futures traded higher. CZ21 is nearing 4.00. US farmer continues to be a reluctant seller. Most will wait for harvest to see wheat yields are. Some may wait longer. Last year, farmers who sold before Jan 1 did not get Covid relief aid. POTUS announced a new payment of $14 billion dollars. There is also a revenue payment due to farmers of $6.9 billion. USDA is asking Congress for $30 billion for CCC funding. Including all needs and payments USDA has paid farmers this year a record $50 billion. Managed funds were buyers of 2,000 corn. Managed funds are net long 80,000 corn. Fact Asian corn were sharply higher overnight is supporting US futures. US Midwest 2 week weather forecast suggest normal to below temps the rest of this week and normal temps the second. 2 week rainfall will be mostly below normal. NOAA 30 day US Midwest forecast calls for normal to above temps and normal to below rains. It remains drier than normal for parts of East Europe and Black Sea. It is also drier than normal in Argentina. USDA announced 210 mt US corn was sold to China. Weekly USDA sales report showed China corn commit near 9.2 mmt and unknown 2.4 mmt. Corn is also supported by dry weather in East Europe, Black Sea and Argentina. Some are already saying that dry pockets of US Midwest soils could carry over into 2021 spring. Some feel US 2021 spring will not be as wet as the last few years especially in ECB.

WHEAT

Wheat futures traded sharply higher. Volume increased as Chicago, KC and Minn made new highs for the move. Next WZ resistance is near 6.00. KWZ resistance is near 5.20. Most of the buying is due to dryness across East Europe, Black Sea and Argentina. Argentina rates their wheat crop only 14 pct good/ex. There is also talk that in Ukraine farmers are trying to plant wheat in dry dirt. The wheat is not germinating. There are no rains forecasted for the Black Sea for the rest of August. There has also been reports that Romania may halt wheat exports. This due to lower supplies. This has also rallied French futures and Black Sea prices. Managed funds were buyers of 7,000 wheat. Managed funds are net long 40,000 wheat. Food and Ag Commodities Economics (Informa) US 2021 corn acres near 93.7, soybeans 87.1, all wheat 45.4 versus USDA 2020 planted acres of 92.0 corn, 83.8 soybeans and 44.3 all wheat. There is talk that Russia wheat prices trade near $240-245 per tonne. US HRW export prices were near $248. On August 18, Russia prices were near $198.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.