Soybeans, soyoil, corn traded unchanged. Soymeal traded lower. Wheat traded higher.US stocks were higher. US Dollar was higher. Crude was higher today.

SOYBEANS

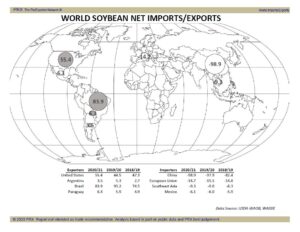

Soybean traded unchanged. Talk of lower US supply and increase China demand for US soybean offered support. USDA announced 132 mt US soybean sold to unknown. Some feel this could be either EU or Mexico. Some feel China is starting to price Feb/Mar needs from Brazil. USDA estimates US 20/21 soybean exports near 2,125 mil bu versus 1,650 this year. In August USDA estimated US harvested soybean acres near 83.0 and yield near 53.3. Most doubt acres will drop but yield could be closer to 52.0. This could drop production 100 mil bu. Bears are adding to 2020/21 carryin and taking 2020/21 demand down but 2020/21 carryout could be closer to 510 than USDA current guess of 610. Bears are also suggesting US farmers add to 2020 crop cash sales. Two separate crop analyst estimated US 2020 soybean crop at 4,388 and 4,400 mil bu respectively. USDA August guess was 4.425. This could suggest a US 2020/21 soybean carryout either 418 or 577 mil bu. USDA August guess was 610.

CORN

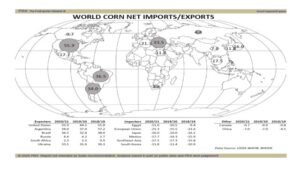

Corn futures traded unchanged. Talk of lower US supply and increase US sales to China offered support. Approaching US 2020 harvest could start to offer seasonal resistance. Bears feel supply Bulls may be running out of new news and that harvest pressure could erase most of the August gains. USDA dropped weekly US corn crop rating to 62 pct good/ex. Drop was in IA. MI and OH crops are also rated below average. Best crops are in KY, WI, MN, MO and SD. 62 pct pf the crop is dented versus 37 last year. Next USDA report is Sep 11. In August USDA estimated US harvested corn acres near 84.0 and yield near 181.8. Some feel acres could be down 500 t and yield closer to 178. This could drop production 415 mil bu. Bears are adding to 2020/21 carryin and taking 2020/21 demand down. This could suggest a carryout near USDA current guess of 2,756. Two separate crop analyst estimated US 2020 corn crop at 14,860 and 15,085 mil bu respectively. USDA August guess was 15,278. This could suggest a US 2020/21 corn carryout either 2,175 or 2,600 mil bu. USDA August guess was 2,756. USDA announced 596 new US corn sales to China, Some feel total US commit is near 9 mmt. Some forecast total China 2021 imports near 20 mmt, 12 from US, 4 from Brazil and 4 from Ukraine.

WHEAT

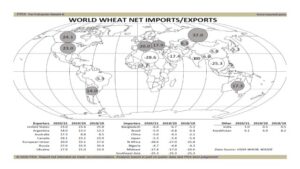

Wheat futures traded higher. There was some talk of new money coming in and buying wheat futures. Of late, wheat futures have been supported by higher US and Black Sea futures. This linked to a lack of farmer selling and a pickup in Black Sea export interest. Today was a new month and there was talk of increase fund buying as a hedge against inflation. There is no inflation signals yet but US Fed Chairman comment and higher lumber and copper markets may be a signal of improve US housing. World numbers have not changed. USDA estimates World 20/21 wheat carryout at a record 317 mmt. Trade is also record 188 mmt. Russia and Ukraine combine for 55.5 mmt. EU is down from last year and near 25.5 mmt. Australia is up to near 17.5 mmt. Canada is near 24.5 mmt. US remains near 26.5 mmt. Argentina is estimated near 14.0 mmt. Some question import numbers due to drop in demand due to Covid.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.