Talk of lower US supplies, positive talks between US and China on trade and massive fund buying pushed prices higher. Farmer was equal big seller of cash. Soybeans, soymeal, soyoil, corn and wheat traded higher. US stocks were lower. US Dollar was lower. Crude was higher.

SOYBEANS

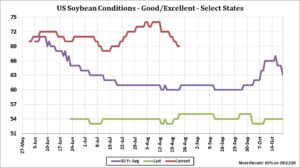

Fact USDA dropped US weekly soybean crop ratings offered support tothe overnight trade. Continued hot and dry US Midwest weather this week also helped. World that China and US had positive trade talks helped prices. News of new US soybean sales to China and unknown triggered additional buying. Key resistance could be near 9.25 SX. USDA dropped US soybean crop rating to 69 pct good/ex. This was a little more than expected. Some now look for US final 2020 corn yield to be near 52 versus USDA 53.3. Most of the decline was in IA, MI, SD and KS. The lower yield suggest a drop in crop size of 100 mil bu. This could drop US 2020/21 soybean carryout to closer to 510 mil bu. This remains adequate for demand. US farmers should consider adding to 2020 cash sales and starting to sell 2021 cash. Talk of record 2021 South America soybean supplies could limit the upside in prices. USDA announced 204 mt US soybeans sold to China for 2020/21 crop year and 142.5 mt US corn sold to unknown for 2020/21 crop year.

CORN

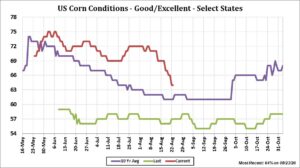

Corn futures traded higher and near session highs. Higher than expected drop in weekly US corn crop ratings and news that China bought US corn triggered massive fund short covering. Farmers were equal sellers of cash. Dec corn futures gapped open higher and will soon test last moving average resistance near 3.60. Some feel once the funds have covered their remaining short position futures could run into resistance. USDA dropped US corn crop rating to 64 pct good/ex. This was more than expected. Some now look for US final 2020 corn yield to be near 178 versus USDA 181.8. Most of the decline was in IA, MI, SD and OH. The lower yield suggest a drop in crop size of 326 mil bu. This could drop US 2020/21 corn carryout to closer to 2,430 mil bu. This remains adequate for demand. Covid reduced demand could limit further upside in prices. US farmers should consider adding to 2020 cash sales and starting to sell 2021 cash. USDA announced 408 mt US corn sold to China for 2020/21 crop year and 100 mt US corn sold to Japan for 2020/21 crop year. It remains dry over most of the US Midwest. Hurricane Laura will hit the US gulf coast Wednesday night and Thursday. This could bring heavy rains to parts of the south Delta. Weather forecast still suggest a cold front will bring .50-2.50 inches of rain across the central and east Midwest early next week. FH Sep weather maps suggest normal rains and normal to below temps for much of the Midwest.

WHEAT

Wheat futures rallied today and following higher trade in corn and lower trade in US Dollar. Word that US and China had positive trade talks raised hope that they might buy additional US wheat. Hot and dry US south plains weather could also begin to raise concern about 2021US winter wheat planting conditions. Interesting that those who are beginning to look at US 2021 weather could see some dryness carryover into the spring of 2021 and La Nina could suggest more hit and miss 2021 rains versus the wet spring we have been enjoying over the last few years. Wheat future appear to be following the higher corn trade. French wheat futures rallied on new China demand. Still talk of higher Russia, Australia and Canada supplies could limit the upside in wheat futures. US farmers should consider starting to sell 2021 cash. USDA still estimating 2020/21 World crop near 766 mmt, trade near 188 mmt and end stocks a record 316 mmt. WZ is near 200 day moving average resistance near 5.42. Futures are becoming overbought.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.