Soybeans, soymeal, and corn traded higher. Wheat and soyoil traded lower. US stocks were higher. US Dollar was higher. Crude was higher. Gold was higher. Big debate on if next economic move is continued deflation or inflations.

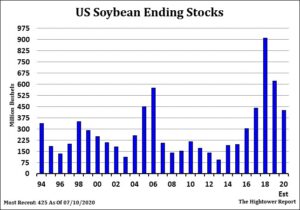

SOYBEANS

Soybean futures and soymeal traded higher. Some link the Buying is soybeans due to new sales of new crop US soybean To China. Higher soymeal could be short covering in front of this week’s USDA report. Weekly US soybean exports were near 23 mil bu versus 34 last year. Season to date exports are near 1,470 mil bu versus 1,555 last year. USDA goal is 1,650 which may be high. USDA announced new new crop US soybean sales of 739 mt. There was also talk that China may have bought 7-10 cargoes of US new crop soybeans today. The average trade guess for US 2020 soybean crop is near 4,258 mil bu versus USDA 4,135 versus USDA 4,135. Range of guesses is 4,135 to 4,399. There is a private guess that the final crop could be 4,496. The average trade guess for US 2020/21 soybean carryout is near 525 mil bu versus USDA 425. This and talk of a record 2021 Brazil soybean crop is negative to prices.

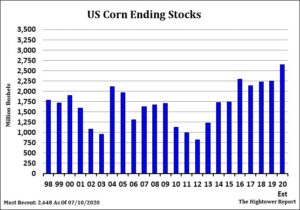

CORN

Corn futures traded higher. Some link the buying to short covering In front of the weeks USDA report. Managed funds have added to their net short position of late. Some also link the buying due to spread buying due to firm cash prices as US farmer remains a reluctant seller of corn. Weekly US corn exports were near 45 mil bu versus 28 last year. Season to date exports are near 1,540 mil bu versus 1,797 last year. USDA goal is 1,775 which may be high. The average trade guess for Wednesday US 2020 corn crop is near 15,170 mil bu versus USDA 15,000. This will be the first official NASS crop estimate. It will be only a farmer survey. Range of guesses is 14,925 to 15,401. The average trade guess for US 2020/21 corn carryout is near 2,800 mil bu versus USDA 2,648. Increase supply without equal increase in demand could continue to weigh on prices. There was talk that China continues to sell Wheat and rice from reserves for feed. Wheat prices were near $7.00 per bushel and $1.00 below corn prices. Some feel China could sell as much as 20-22 mmt of wheat and rice from reserves. China also reported that they could import feed for increasing Animal numbers.

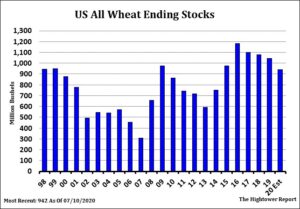

WHEAT

Wheat futures traded lower. French futures continued lower on Talk of higher Russia crop. There was also talk of lower Australia Prices due to their higher crop. Higher Australia crop could cut Into Canada exports to Asia. US export prices remain above Europe and Russia. Weekly US wheat exports were near 14 mil bu versus 26 last year. Season to date exports are near 186 mil bu versus 182 last year. USDA goal is 950. The average trade guess for US 2020 wheat crop is near 1,833 mil bu versus USDA 1,824.Key to wheat numbers is if USDA increases Russia, Canada and Australia crops and adds to already record World supplies. There was talk today that combined, Canada and Australia Could produce 22-24 mmt more wheat than last year. This also suggest that they could have 12-14 mmt more export than last year. Some feel WU could try to make a bottom in September near 4.70.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.