TODAY—WEEKLY EXPORT SALES

Overnight trade has SRW Wheat up roughly 5 cents, HRW up 4; HRS Wheat up 7, Corn is up 2 cents; Soybeans up 6; Soymeal up $1.00, and Soyoil up 30 points.

Chinese Ag futures (January) settled up 28 yuan in soybeans, down 10 in Corn, down 11 in Soymeal, up 124 in Soyoil, and up 70 in Palm Oil.

Malaysian palm oil prices were up 35 ringgit at 2,680 (basis November) tracking rival oils but, concerns of weak demand capped gains.

The 6 to 10 day forecast for the Midwest switched to now seeing a lesser amount of rainfall across much of the region with any rainfall coming early in the period and favoring the Ohio River valley; temps will be above average the rest of the week and into the weekend then, fall to below average the first half of the week and remain there for the rest of the week.

The 11 to 16 day forecast for the Midwest has a bit less than average rainfall for the region and below average temps; temps may be flirting near 32 degrees in far northern sections of the Midwest by the end of the period (the GFS model showing colder temps then what the European model is offering).

The player sheet had funds net buyers of 5,000 contracts of SRW Wheat; net sold 1,000 Corn; bought 7,000 Soybeans; net sold 1,000 lots of Soymeal, and; bought 2,000 Soyoil.

We estimate Managed Money net long 7,000 contracts of SRW Wheat; short 66,000 Corn; net long 122,000 Soybeans; net long 6,000 lots of Soymeal, and; long 63,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 4,700 contracts; HRW Wheat down 2,300; Corn down 29,600; Soybeans up 1,500 contracts; Soymeal up 2,100 lots, and; Soyoil up 3,600.

There were no changes in registrations—Registrations total 95 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 23; Soyoil 2,632 lots; Soymeal 511; Rice ZERO; HRW Wheat 47, and; HRS 1,387.

Tender Activity—Turkey bought 390,000t optional-origin milling wheat, 110,000t durum—Japan bought 100,952t U.S./Canadian wheat—Jordan bought 60,000t optional-origin wheat—Taiwan bought 99,895t U.S. wheat—S. Korea bought 65,000t optional-origin feed wheat—S. Korea bought 60,000t S. American soymeal—

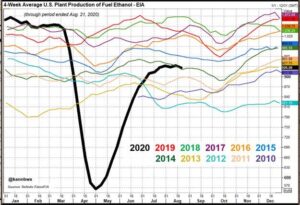

U.S. ethanol production for the week ended August 21st averaged 931,000 barrels per day (up 0.54% versus a week ago, down 10.31% versus a year ago); stocks totaled 20.41 mil barrels (up 0.69% versus a week ago, down 11.20% versus last year); corn use for the week was 93.3 mil bu (92.8 mil last week) and versus the 88.1 mil bu needed to meet USDA projections.

The Environmental Protection Agency has not made a decision on U.S. biofuel blending requirements for 2021 or on petitions from refiners asking to be exempted from past-year requirements going back to 2011, EPA Administrator Andrew Wheeler said; he could not assure that the agency will decide the 2021 Renewable Volume Obligations (RVO) by the Nov. 30 deadline due to the impact of the COVID-19 pandemic.

Wire story commented on U.S. ethanol production quickly bounced back after its pandemic-driven crash in late March and April, though both output and use have plateaued in the last month and remain below typical levels, a bit unsettling as far as corn demand is concerned.

China has proposed a “soybean industry alliance” with Russia as it seeks to deepen economic ties with its strategic partner – despite making a commitment to buy more of the oilseed from the US; the Commerce Minister called for closer cooperation with Russia in all areas of the soybean supply chain; also said Beijing and Moscow should “match up” their major soybean production areas and build an industry alliance.

The size of the soybean-planted area covered by agricultural insurance in Brazil may more than double in the 2020/21 season, reaching 10 million hectares (24.71 million acres) for the first time, after profitable prices boosted advance sales of about half of production even before planting begins in September.

Argentine grains inspectors represented by the Urgara union will hold a 36-hour wage strike starting on Friday, the labor group said in a statement on Wednesday, a move that could affect grains exports; discussions about the workers’ next raise should have started by the end of June, but had yet to begin.

Ukraine since the beginning of the new 2020/2021 marketing year (MY, July-June) and as of August 26 had exported 5.93 million tons of grain and legumes, which is 1.7 million tons less (due to corn) than on this date in the past MYG.

The European Union cut its duty on maize (corn) imports to zero on Thursday a day after lowering it to 0.26 euros/ton, the bloc announced; the new zero-rated duty is effective as of Thursday.

European wheat prices edged lower on Wednesday in a market that traders said was lacking direction in the absence of new fundamental elements and was under pressure from a poor export outlook this season; benchmark December milling wheat unofficially closed down 0.1% at 184.00 euros a ton.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.